Alessandra Cretarola

6 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

BSDE-based stochastic control for optimal reinsurance in a dynamic contagion model

We investigate the optimal reinsurance problem in the risk model with jump clustering features introduced in [7]. This modeling framework is inspired by the concept initially proposed in [15], combi...

Utility-based indifference pricing of pure endowments in a Markov-modulated market model

In this paper we study exponential utility indifference pricing of pure endowment policies in a stochastic-factor model for an insurance company, which can also invest in a financial market. Specifi...

Optimal investment and reinsurance under exponential forward preferences

We study the optimal investment and proportional reinsurance problem of an insurance company, whose investment preferences are described via a forward dynamic utility of exponential type in a stocha...

Self-protection and self-insurance for general risk models via a BSDE approach

We investigate an optimal prevention and insurance problem in a general risk setting, where a representative agent is exposed to potential losses. The agent adopts a strategy that combines self-protec...

Existence of nonnegative mild solutions of stochastic evolution inclusions via weak topology

This paper addresses the existence of nonnegative mild solutions for stochastic evolution inclusions through a weak topology approach. Precisely, the study focuses on stochastic evolution inclusions c...

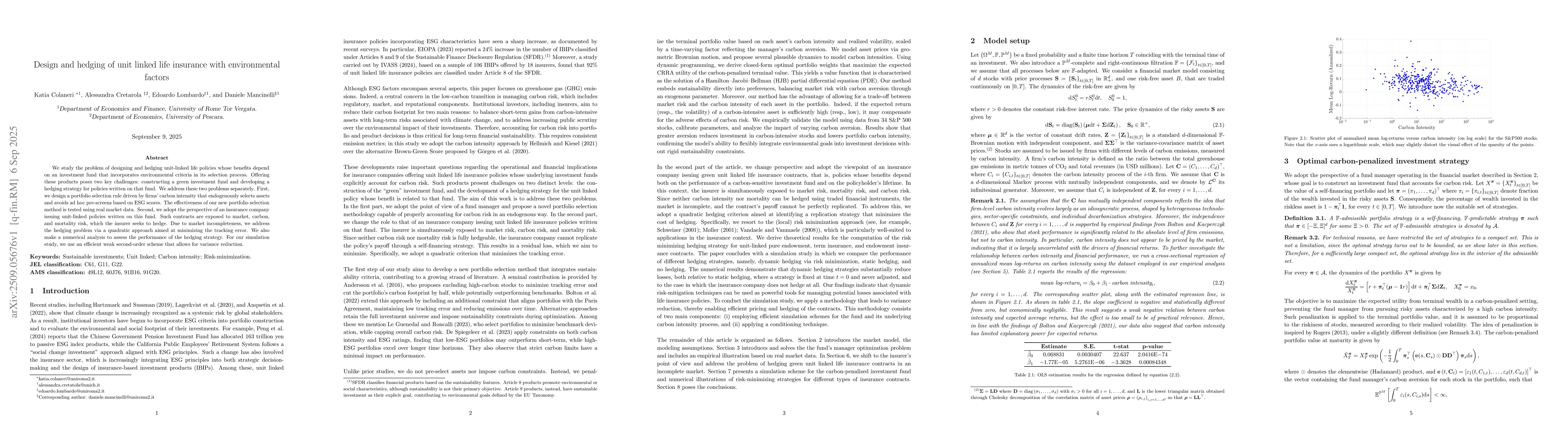

Design and hedging of unit linked life insurance with environmental factors

We study the problem of designing and hedging unit-linked life policies whose benefits depend on an investment fund that incorporates environmental criteria in its selection process. Offering these pr...