Alex A. T. Rathke

5 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Profit shifting under the arm's length principle

This study analyses the tax-induced profit shifting behaviour of firms and the impact of governments' anti-shifting rules. We derive a model of a firm that combines internal sales and internal debt ...

On the state-space model of unawareness

We show that the knowledge of an agent carrying non-trivial unawareness violates the standard property of 'necessitation', therefore necessitation cannot be used to refute the standard state-space m...

Taxpayer deductions and the endogenous probability of tax penalisation

We propose a parametric specification of the probability of tax penalisation faced by a taxpayer, based on the amount of deduction chosen by her to reduce total taxation. Comparative analyses lead t...

Revisiting the state-space model of unawareness

We propose a knowledge operator based on the agent's possibility correspondence which preserves her non-trivial unawareness within the standard state-space model. Our approach may provide a solution t...

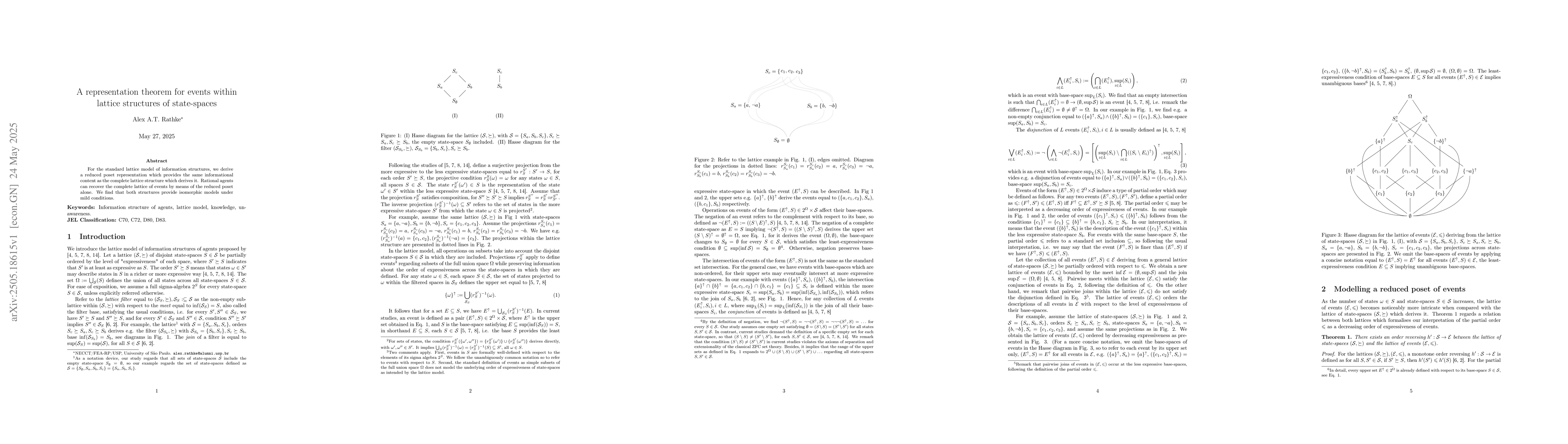

A representation theorem for events within lattice structures of state-spaces

For the standard lattice model of information structures, we derive a reduced poset representation which provides the same informational content as the complete lattice structure which derives it. Rat...