Difang Huang

6 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Estimating the Impact of Social Distance Policy in Mitigating COVID-19 Spread with Factor-Based Imputation Approach

We identify the effectiveness of social distancing policies in reducing the transmission of the COVID-19 spread. We build a model that measures the relative frequency and geographic distribution of ...

Estimating Contagion Mechanism in Global Equity Market with Time-Zone Effect

This paper proposes a time-zone vector autoregression (VAR) model to investigate comovements in the global financial market. Analyzing daily data from 36 national equity markets, we explore the subp...

Dynamic Analyses of Contagion Risk and Module Evolution on the SSE A-Shares Market Based on Minimum Information Entropy

The interactive effect is significant in the Chinese stock market, exacerbating the abnormal market volatilities and risk contagion. Based on daily stock returns in the Shanghai Stock Exchange (SSE)...

Dynamic Correlation of Market Connectivity, Risk Spillover and Abnormal Volatility in Stock Price

The connectivity of stock markets reflects the information efficiency of capital markets and contributes to interior risk contagion and spillover effects. We compare Shanghai Stock Exchange A-shares...

Measuring Gender and Racial Biases in Large Language Models

In traditional decision making processes, social biases of human decision makers can lead to unequal economic outcomes for underrepresented social groups, such as women, racial or ethnic minorities....

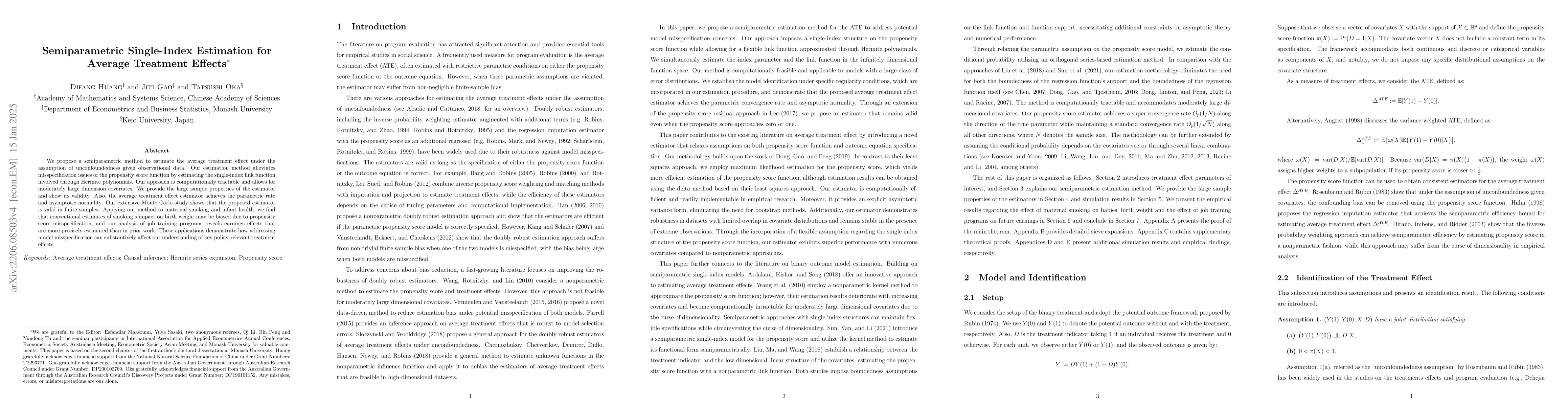

Semiparametric Single-Index Estimation for Average Treatment Effects

We propose a semiparametric method to estimate the average treatment effect under the assumption of unconfoundedness given observational data. Our estimation method alleviates misspecification issue...