Eulalia Nualart

11 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

On the implied volatility of Inverse and Quanto Inverse options under stochastic volatility models

In this paper we study short-time behavior of the at-the-money implied volatility for Inverse and Quanto Inverse European options with fixed strike price. The asset price is assumed to follow a gene...

On the implied volatility of European and Asian call options under the stochastic volatility Bachelier model

In this paper we study the short-time behavior of the at-the-money implied volatility for European and arithmetic Asian call options with fixed strike price. The asset price is assumed to follow the...

Instantaneous everywhere-blowup of parabolic SPDEs

We consider the following stochastic heat equation \begin{equation*} \partial_t u(t\,,x) = \tfrac12 \partial^2_x u(t\,,x) + b(u(t\,,x)) + \sigma(u(t\,,x)) \dot{W}(t\,,x), \end{equation*} defined f...

On the implied volatility of Asian options under stochastic volatility models

In this paper we study the short-time behavior of the at-the-money implied volatility for arithmetic Asian options with fixed strike price. The asset price is assumed to follow the Black-Scholes mod...

Optimal convergence rates for the invariant density estimation of jump-diffusion processes

We aim at estimating the invariant density associated to a stochastic differential equation with jumps in low dimension, which is for $d=1$ and $d=2$. We consider a class of jump diffusion processes...

Convergence of continuous-time stochastic gradient descent with applications to linear deep neural networks

We study a continuous-time approximation of the stochastic gradient descent process for minimizing the expected loss in learning problems. The main results establish general sufficient conditions for ...

Fast convergence rates for estimating the stationary density in SDEs driven by a fractional Brownian motion with semi-contractive drift

We consider the solution of an additive fractional stochastic differential equation (SDE) and, leveraging continuous observations of the process, introduce a methodology for estimating its stationary ...

On the well-posedness of SPDEs with locally Lipschitz coefficients

We consider the stochastic partial differential equation, $\partial_t u = \tfrac12 \partial^2_x u + b(u) + \sigma(u) \dot{W},$ where $u=u(t\,,x)$ is defined for $(t\,,x)\in(0\,,\infty)\times\mathbb{R}...

Multivariate Poisson approximation of joint subgraph counts in random graphs via size-biased couplings

Using Chen-Stein method in combination with size-biased couplings, we obtain the multivariate Poisson approximation in terms of the Wasserstein distance. As applications, we study the multivariate Poi...

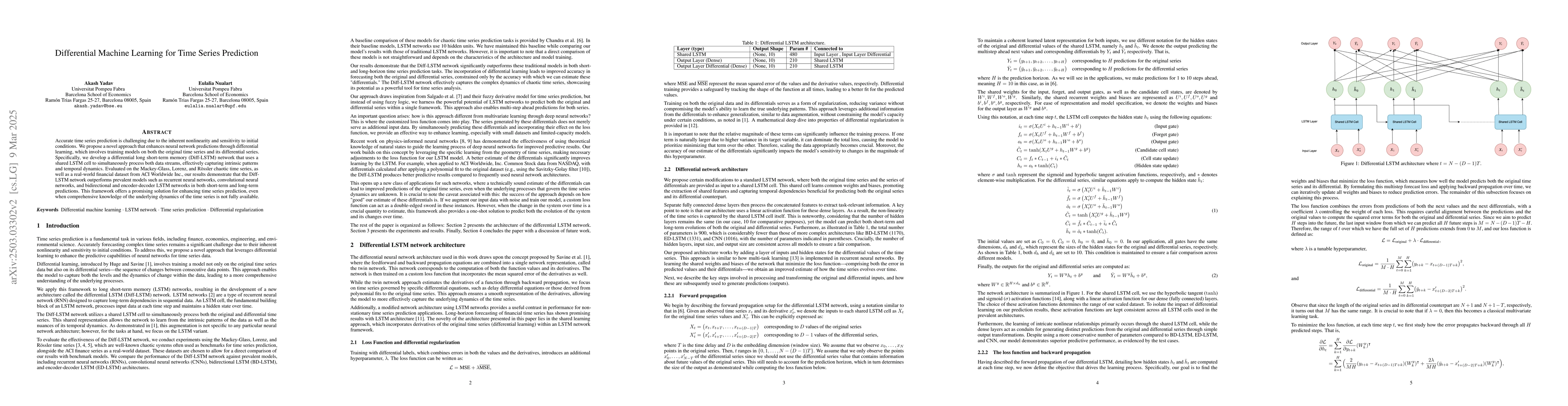

Differential Machine Learning for Time Series Prediction

Accurate time series prediction is challenging due to the inherent nonlinearity and sensitivity to initial conditions. We propose a novel approach that enhances neural network predictions through diff...

On the local well-posedness of randomly forced reaction-diffusion equations with $L^2$ initial data and a superlinear reaction term

We consider a parabolic stochastic partial differential equation (SPDE) on $[0\,,1]$ that is forced with multiplicative space-time white noise with a bounded and Lipschitz diffusion coefficient and a ...