Felix-Benedikt Liebrich

5 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Risk sharing under heterogeneous beliefs without convexity

We consider the problem of finding Pareto-optimal allocations of risk among finitely many agents. The associated individual risk measures are law invariant, but with respect to agent-dependent and p...

Model Uncertainty: A Reverse Approach

Robust models in mathematical finance replace the classical single probability measure by a sufficiently rich set of probability measures on the future states of the world to capture (Knightian) unc...

Multi-asset return risk measures

We revisit the recently introduced concept of return risk measures (RRMs). We extend it by allowing risk management via multiple so-called eligible assets. The resulting new risk measures are called m...

Eliciting reference measures of law-invariant functionals

Law-invariant functionals are central to risk management and assign identical values to random prospects sharing the same distribution under an atomless reference probability measure. This measure is ...

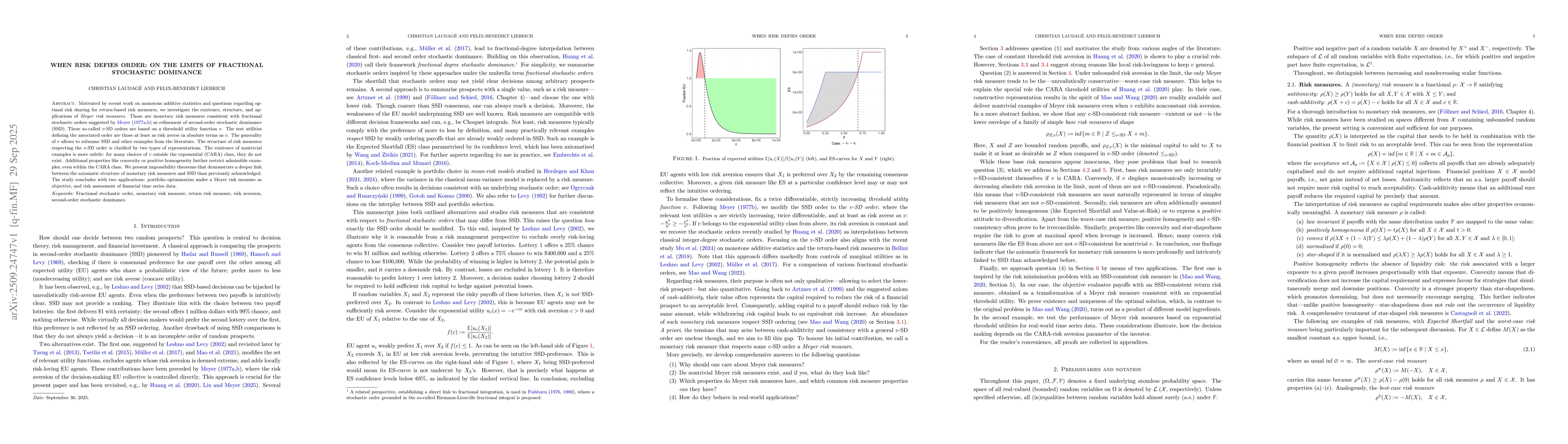

When risk defies order: On the limits of fractional stochastic dominance

Motivated by recent work on monotone additive statistics and questions regarding optimal risk sharing for return-based risk measures, we investigate the existence, structure, and applications of Meyer...