Gechun Liang

17 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Representation of forward performance criteria with random endowment via FBSDE and application to forward optimized certainty equivalent

We extend the notion of forward performance criteria to settings with random endowment in incomplete markets. Building on these results, we introduce and develop the novel concept of forward optimiz...

Predictable Relative Forward Performance Processes: Multi-Agent and Mean Field Games for Portfolio Management

We consider a new framework of predictable relative forward performance processes (PRFPP) to study portfolio management within a competitive environment. Each agent trades a distinct stock following...

Convergence rates for Chernoff-type approximations of convex monotone semigroups

We provide explicit convergence rates for Chernoff-type approximations of convex monotone semigroups which have the form $S(t)f=\lim_{n\to\infty}I(\frac{t}{n})^n f$ for bounded continuous functions ...

A robust $\alpha$-stable central limit theorem under sublinear expectation without integrability condition

This article relaxes the integrability condition imposed in the literature for the robust $\alpha$-stable central limit theorem under sublinear expectation. Specifically, for $\alpha \in(0,1]$, we p...

Vague and weak convergence of signed measures

Necessary and sufficient conditions for weak and vague convergence of measures are important for a diverse host of applications. This paper aims to give a comprehensive description of the relationsh...

A continuity theorem for generalised signed measures with an application to Karamata's Tauberian theorem

The Laplace transforms of positive measures on $\mathbb{R}_{+}$ converge if and only if their distribution functions converge at continuity points of the limiting measure. We extend this classical c...

A new monotonicity condition for ergodic BSDEs and ergodic control with super-quadratic Hamiltonians

We establish the existence (and in an appropriate sense uniqueness) of Markovian solutions for ergodic BSDEs under a novel monotonicity condition. Our monotonicity condition allows us to prove exist...

Callable convertible bonds under liquidity constraints and hybrid priorities

This paper investigates the callable convertible bond problem in the presence of a liquidity constraint modelled by Poisson signals. We assume that neither the bondholder nor the firm has absolute p...

Predictable Forward Performance Processes: Infrequent Evaluation and Applications to Human-Machine Interactions

We study discrete-time predictable forward processes when trading times do not coincide with performance evaluation times in a binomial tree model for the financial market. The key step in the const...

Quantitative stability and numerical analysis of Markovian quadratic BSDEs with reflection

We study the quantitative stability of the solutions to Markovian quadratic reflected BSDEs with bounded terminal data. By virtue of BMO martingale and change of measure techniques, we obtain stabil...

A monotone scheme for G-equations with application to the explicit convergence rate of robust central limit theorem

We propose a monotone approximation scheme for a class of fully nonlinear PDEs called G-equations. Such equations arise often in the characterization of G-distributed random variables in a sublinear...

Optimal investment and consumption with forward preferences and uncertain parameters

This paper studies robust forward investment and consumption preferences within a zero-volatility context. Different from previous works, we consider an incomplete financial market model due to gene...

Utility maximization in constrained and unbounded financial markets: Applications to indifference valuation, regime switching, consumption and Epstein-Zin recursive utility

This memoir presents a systematic study of utility maximization problems for an investor in constrained and unbounded financial markets. Building upon the foundational work of Hu et al. (2005) [Ann....

Robust forward investment and consumption under drift and volatility uncertainties: A randomization approach

This paper studies robust forward investment and consumption preferences and optimal strategies for a risk-averse and ambiguity-averse agent in an incomplete financial market with drift and volatility...

Recursive Optimal Stopping with Poisson Stopping Constraints

This paper solves a recursive optimal stopping problem with Poisson stopping constraints using the penalized backward stochastic differential equation (PBSDE) with jumps. Stopping in this problem is o...

Zero-sum Dynkin games under common and independent Poisson constraints

Zero-sum Dynkin games under the Poisson constraint have been studied widely in the recent literature. In such a game the players are only allowed to stop at the event times of a Poisson process. The c...

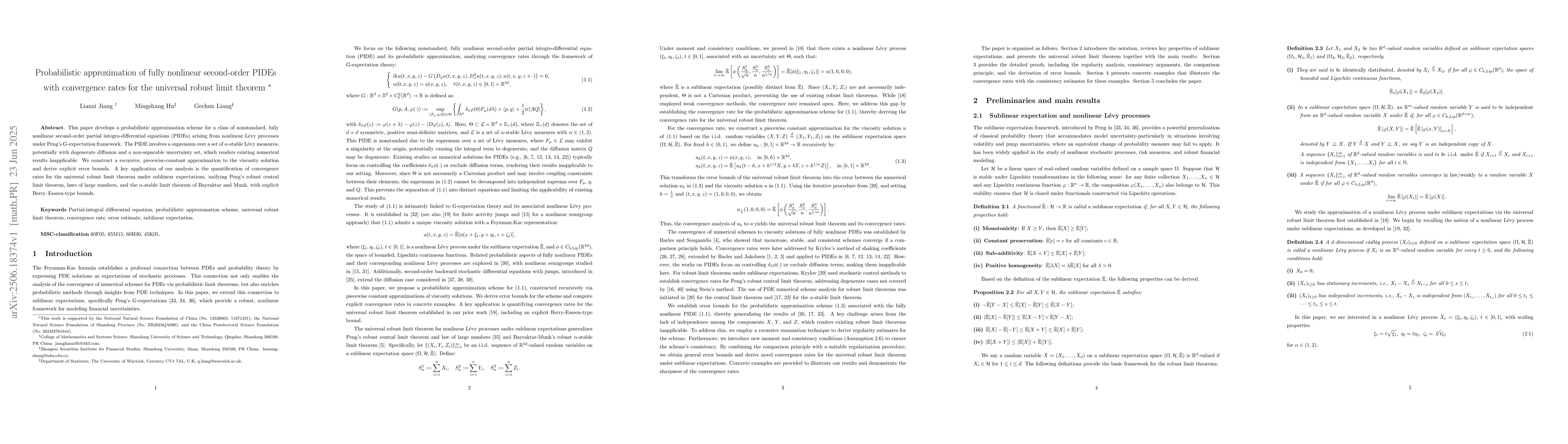

Probabilistic approximation of fully nonlinear second-order PIDEs with convergence rates for the universal robust limit theorem

This paper develops a probabilistic approximation scheme for a class of nonstandard, fully nonlinear second-order partial integro-differential equations (PIDEs) arising from nonlinear L\'evy processes...