Jian'an Zhang

8 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

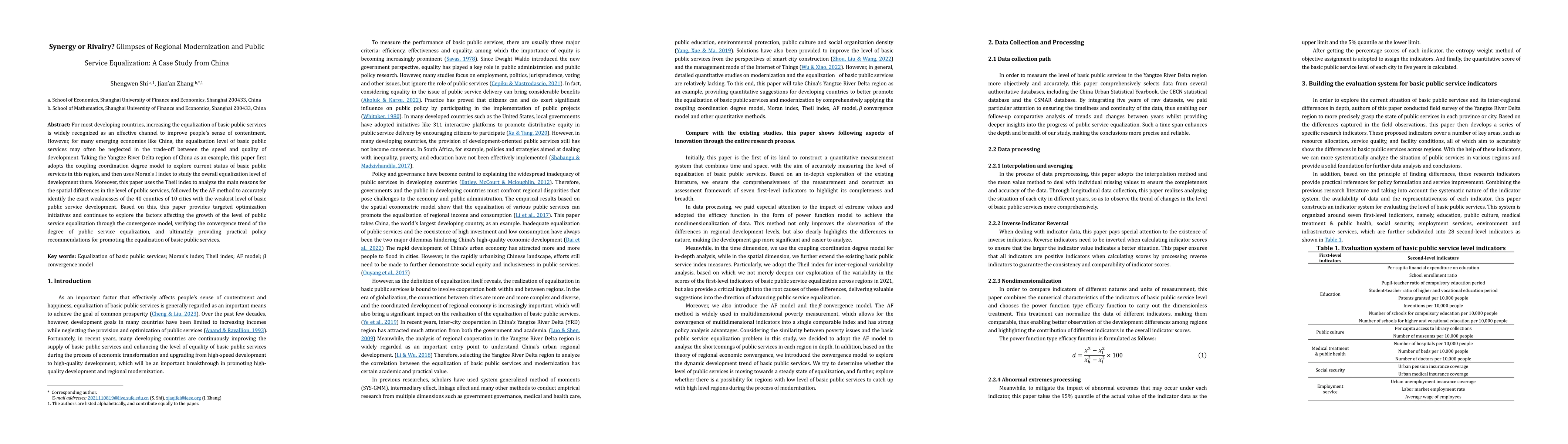

Synergy or Rivalry? Glimpses of Regional Modernization and Public Service Equalization: A Case Study from China

For most developing countries, increasing the equalization of basic public services is widely recognized as an effective channel to improve people's sense of contentment. However, for many emerging ...

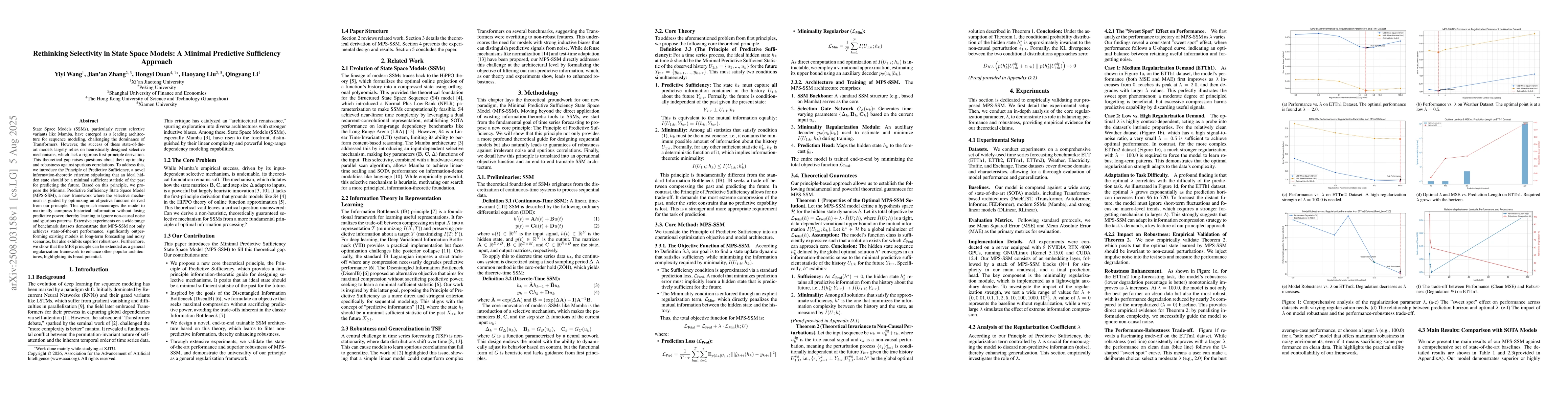

Rethinking Selectivity in State Space Models: A Minimal Predictive Sufficiency Approach

State Space Models (SSMs), particularly recent selective variants like Mamba, have emerged as a leading architecture for sequence modeling, challenging the dominance of Transformers. However, the succ...

Triangle Detection in Worst-Case Sparse Graphs via Local Sketching

We present a non-algebraic, locality-preserving framework for triangle detection in worst-case sparse graphs. Our algorithm processes the graph in $O(\log n)$ independent layers and partitions inciden...

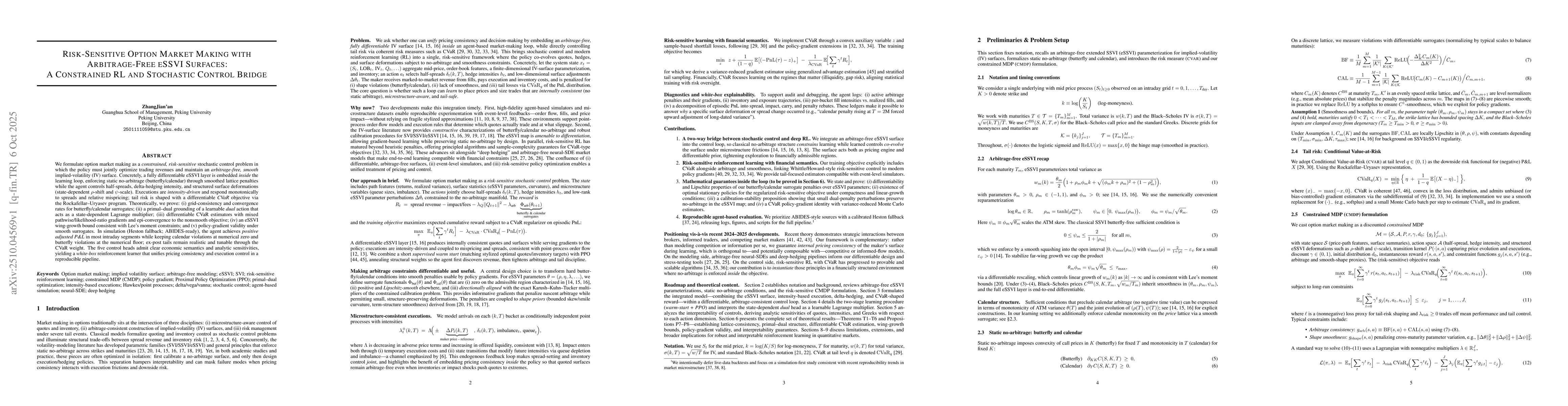

Risk-Sensitive Option Market Making with Arbitrage-Free eSSVI Surfaces: A Constrained RL and Stochastic Control Bridge

We formulate option market making as a constrained, risk-sensitive control problem that unifies execution, hedging, and arbitrage-free implied-volatility surfaces inside a single learning loop. A full...

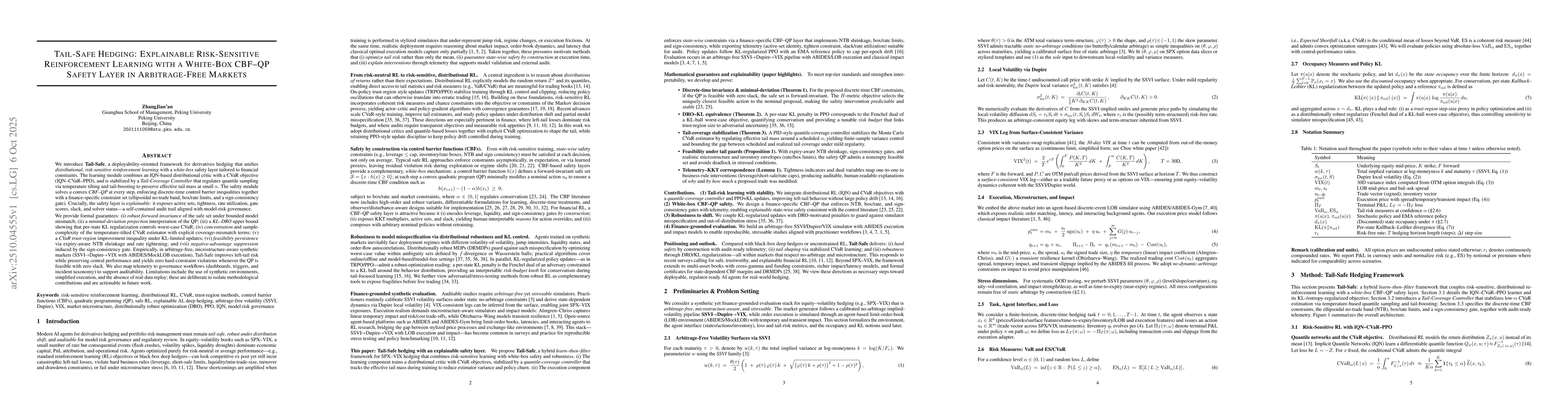

Tail-Safe Hedging: Explainable Risk-Sensitive Reinforcement Learning with a White-Box CBF--QP Safety Layer in Arbitrage-Free Markets

We introduce Tail-Safe, a deployability-oriented framework for derivatives hedging that unifies distributional, risk-sensitive reinforcement learning with a white-box control-barrier-function (CBF) qu...

FR-LUX: Friction-Aware, Regime-Conditioned Policy Optimization for Implementable Portfolio Management

Transaction costs and regime shifts are major reasons why paper portfolios fail in live trading. We introduce FR-LUX (Friction-aware, Regime-conditioned Learning under eXecution costs), a reinforcemen...

Tail-Safe Stochastic-Control SPX-VIX Hedging: A White-Box Bridge Between AI Sensitivities and Arbitrage-Free Market Dynamics

We present a white-box, risk-sensitive framework for jointly hedging SPX and VIX exposures under transaction costs and regime shifts. The approach couples an arbitrage-free market teacher with a contr...

Just-In-Time Piecewise-Linear Semantics for ReLU-type Networks

We present a JIT PL semantics for ReLU-type networks that compiles models into a guarded CPWL transducer with shared guards. The system adds hyperplanes only when operands are affine on the current ce...