Lane P. Hughston

8 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

On the Pricing of Storable Commodities

This paper introduces an information-based model for the pricing of storable commodities such as crude oil and natural gas. The model uses the concept of market information about future supply and d...

Decoherence Implies Information Gain

It is shown that if the wave function of a quantum system undergoes an arbitrary random transformation such that the diagonal elements of the density matrix in the basis of a preferred observable re...

Valuation of a Financial Claim Contingent on the Outcome of a Quantum Measurement

We consider a rational agent who at time $0$ enters into a financial contract for which the payout is determined by a quantum measurement at some time $T>0$. The state of the quantum system is given...

Mathematical Foundations of Complex Tonality

Equal temperament, in which semitones are tuned in the irrational ratio of $2^{1/12} : 1$, is best seen as a serviceable compromise, sacrificing purity for flexibility. Just intonation, in which int...

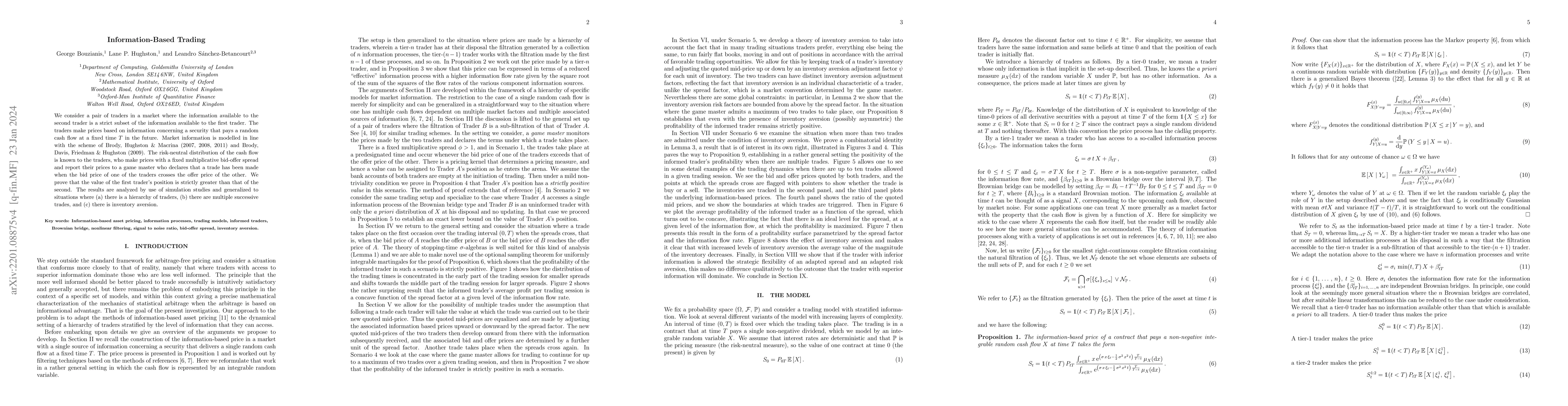

Information-Based Trading

We consider a pair of traders in a market where the information available to the second trader is a strict subset of the information available to the first trader. The traders make prices based on t...

Brief Synopsis of the Scientific Career of T. R. Hurd

As an introduction to a Special Issue of International Journal of Theoretical and Applied Finance in Honour of the Memory of Thomas Robert Hurd we present a brief synopsis of Tom Hurd's scientific car...

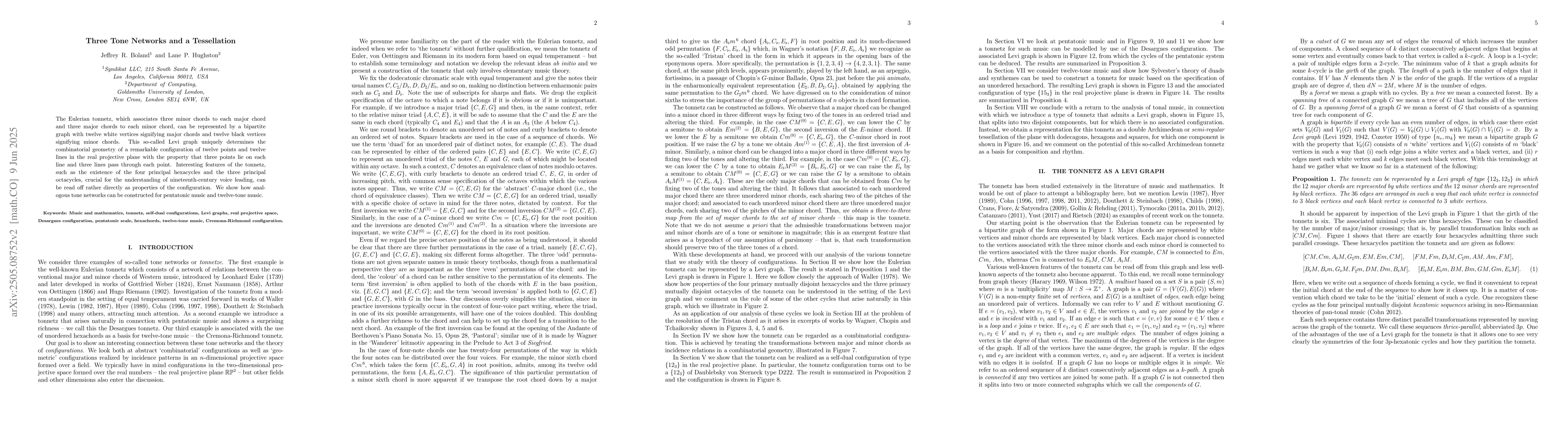

Three Tone Networks and a Tessellation

We show that the Eulerian tonnetz, which associates three minor chords to each major chord and three major chords to each minor chord, can be represented by a bipartite graph with twelve white vertice...

Martingale Projections and Quantum Decoherence

We introduce so-called super/sub-martingale projections as a family of endomorphisms defined on unions of Polish spaces. Such projections allow us to identify martingales as collections of transformat...