Long Pham

7 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

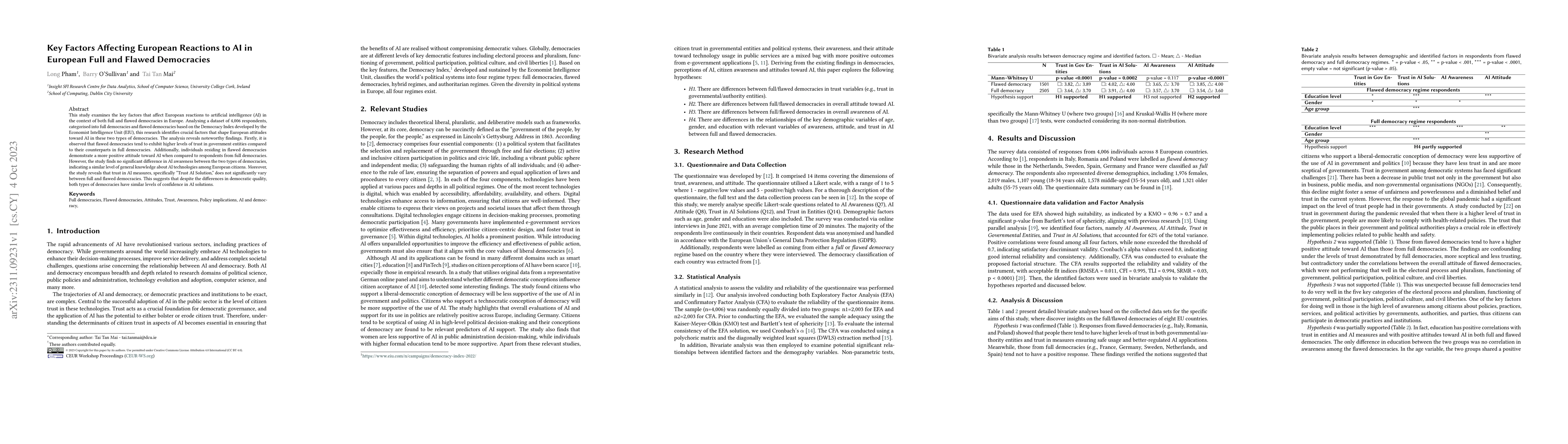

Key Factors Affecting European Reactions to AI in European Full and Flawed Democracies

This study examines the key factors that affect European reactions to artificial intelligence (AI) in the context of both full and flawed democracies in Europe. Analysing a dataset of 4,006 responde...

Worst-Case Input Generation for Concurrent Programs under Non-Monotone Resource Metrics

Worst-case input generation aims to automatically generate inputs that exhibit the worst-case performance of programs. It has several applications, and can, for example, detect vulnerabilities to de...

Artificial Intelligence across Europe: A Study on Awareness, Attitude and Trust

This paper presents the results of an extensive study investigating the opinions on Artificial Intelligence (AI) of a sample of 4,006 European citizens from eight distinct countries (France, Germany...

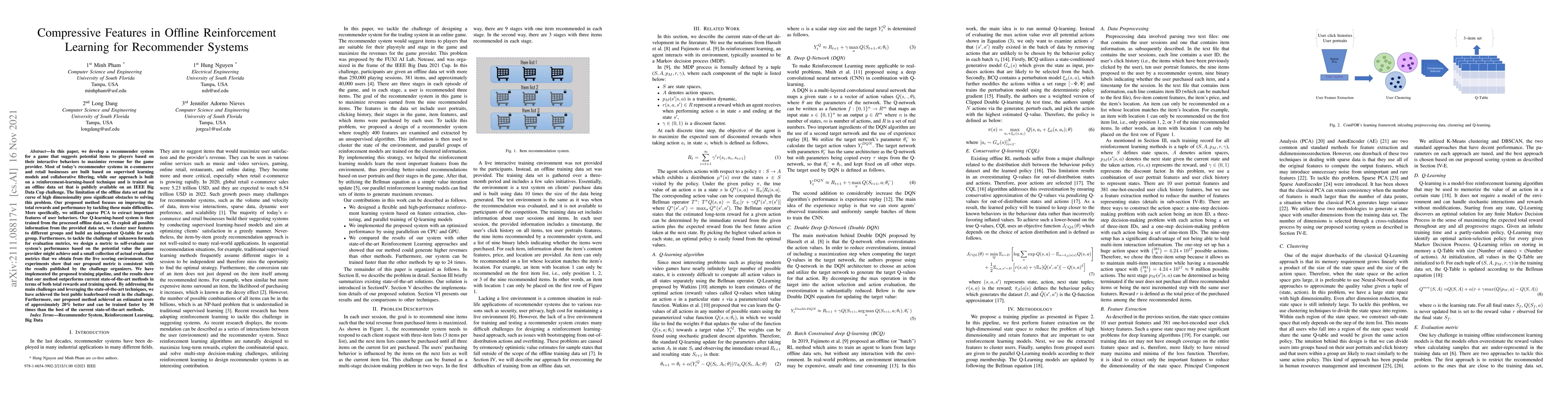

Compressive Features in Offline Reinforcement Learning for Recommender Systems

In this paper, we develop a recommender system for a game that suggests potential items to players based on their interactive behaviors to maximize revenue for the game provider. Our approach is bui...

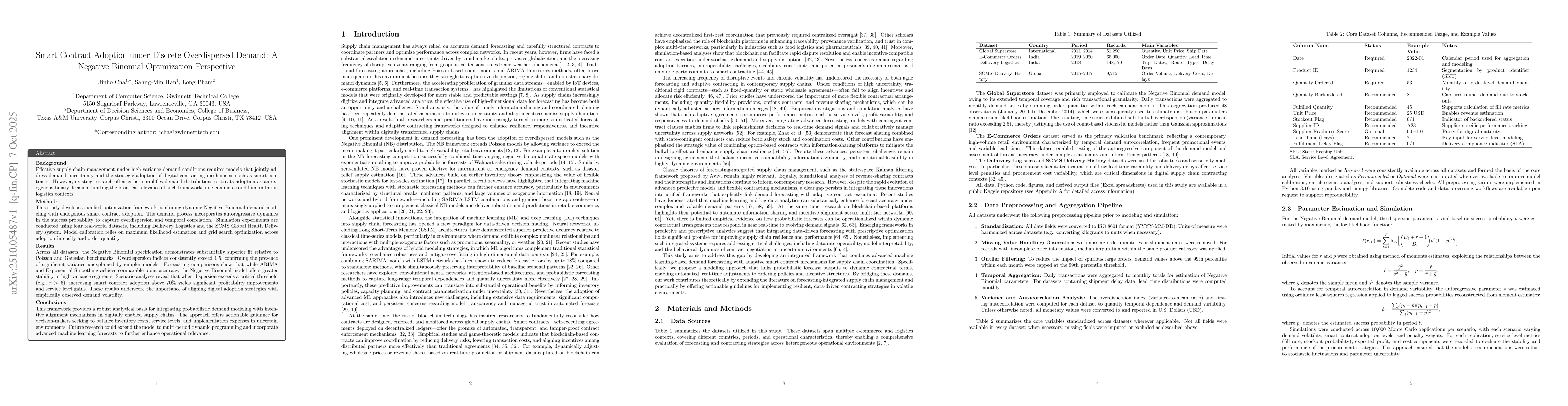

Smart Contract Adoption under Discrete Overdispersed Demand: A Negative Binomial Optimization Perspective

Effective supply chain management under high-variance demand requires models that jointly address demand uncertainty and digital contracting adoption. Existing research often simplifies demand variabi...

Smart Contract Adoption in Derivative Markets under Bounded Risk: An Optimization Approach

This study develops and analyzes an optimization model of smart contract adoption under bounded risk, linking structural theory with simulation and real-world validation. We examine how adoption inten...

Inverse Portfolio Optimization with Synthetic Investor Data: Recovering Risk Preferences under Uncertainty

This study develops an inverse portfolio optimization framework for recovering latent investor preferences including risk aversion, transaction cost sensitivity, and ESG orientation from observed port...