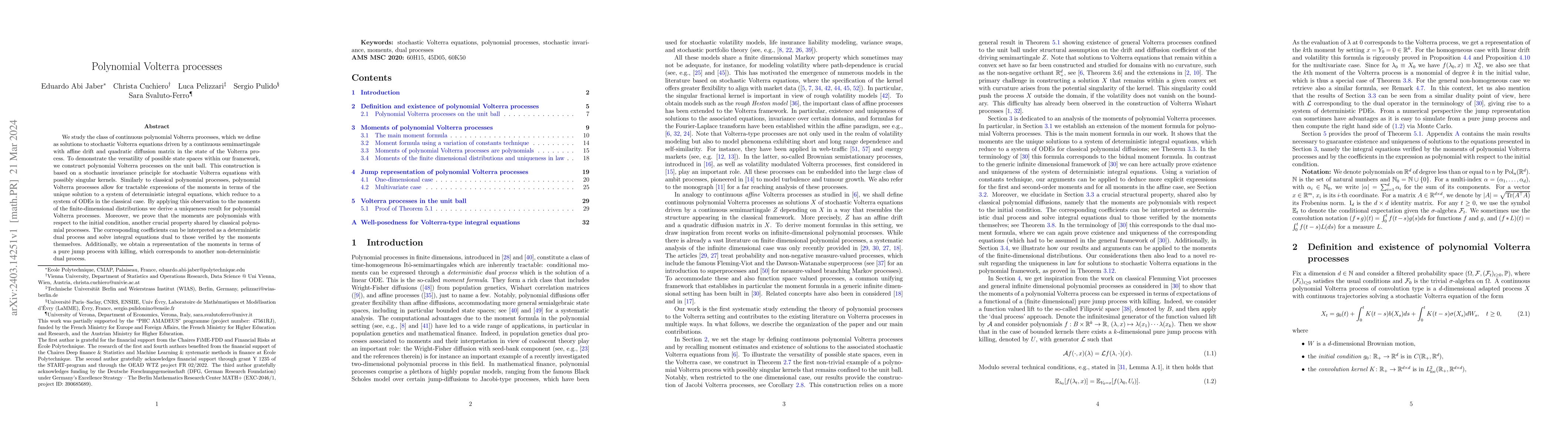

Luca Pelizzari

5 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Polynomial Volterra processes

We study the class of continuous polynomial Volterra processes, which we define as solutions to stochastic Volterra equations driven by a continuous semimartingale with affine drift and quadratic di...

Primal and dual optimal stopping with signatures

We propose two signature-based methods to solve the optimal stopping problem - that is, to price American options - in non-Markovian frameworks. Both methods rely on a global approximation result fo...

Rough PDEs for local stochastic volatility models

In this work, we introduce a novel pricing methodology in general, possibly non-Markovian local stochastic volatility (LSV) models. We observe that by conditioning the LSV dynamics on the Brownian m...

Pricing American options under rough volatility using deep-signatures and signature-kernels

We extend the signature-based primal and dual solutions to the optimal stopping problem recently introduced in [Bayer et al.: Primal and dual optimal stopping with signatures, to appear in Finance & S...

Local regression on path spaces with signature metrics

We study nonparametric regression and classification for path-valued data. We introduce a functional Nadaraya-Watson estimator that combines the signature transform from rough path theory with local k...