Marcelo C. Medeiros

7 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Forecasting inflation using disaggregates and machine learning

This paper examines the effectiveness of several forecasting methods for predicting inflation, focusing on aggregating disaggregated forecasts - also known in the literature as the bottom-up approac...

Forecasting Large Realized Covariance Matrices: The Benefits of Factor Models and Shrinkage

We propose a model to forecast large realized covariance matrices of returns, applying it to the constituents of the S\&P 500 daily. To address the curse of dimensionality, we decompose the return c...

Modeling and Forecasting Intraday Market Returns: a Machine Learning Approach

In this paper we examine the relation between market returns and volatility measures through machine learning methods in a high-frequency environment. We implement a minute-by-minute rolling window ...

Bridging factor and sparse models

Factor and sparse models are two widely used methods to impose a low-dimensional structure in high-dimensions. However, they are seemingly mutually exclusive. We propose a lifting method that combin...

Do We Exploit all Information for Counterfactual Analysis? Benefits of Factor Models and Idiosyncratic Correction

Optimal pricing, i.e., determining the price level that maximizes profit or revenue of a given product, is a vital task for the retail industry. To select such a quantity, one needs first to estimat...

Cost-aware Portfolios in a Large Universe of Assets

This paper considers the finite horizon portfolio rebalancing problem in terms of mean-variance optimization, where decisions are made based on current information on asset returns and transaction cos...

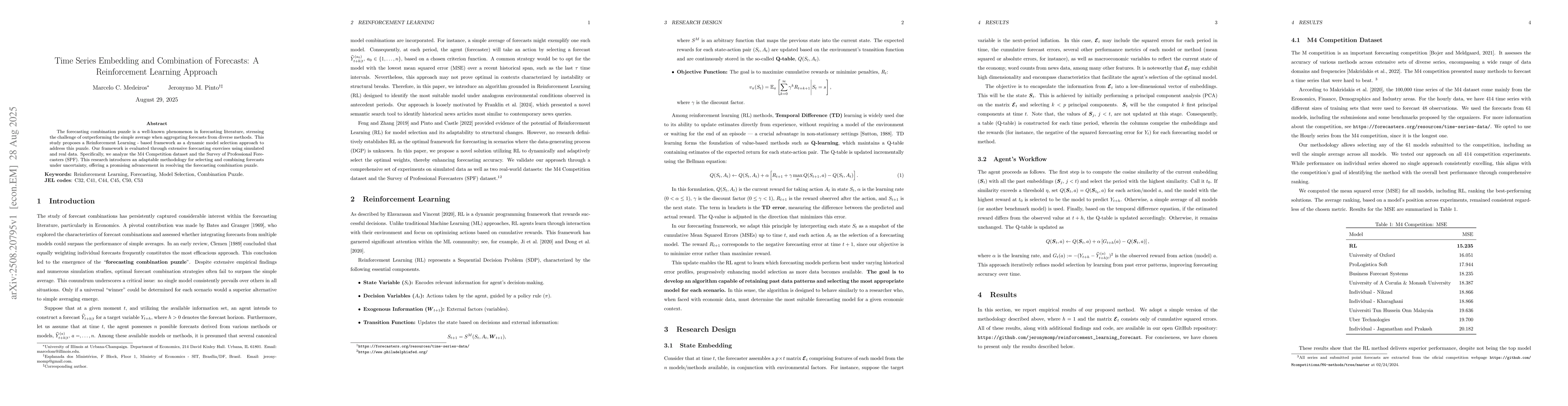

Time Series Embedding and Combination of Forecasts: A Reinforcement Learning Approach

The forecasting combination puzzle is a well-known phenomenon in forecasting literature, stressing the challenge of outperforming the simple average when aggregating forecasts from diverse methods. Th...