Marco Frittelli

4 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Collective Arbitrage and the Value of Cooperation

We introduce the notions of Collective Arbitrage and of Collective Super-replication in a discrete-time setting where agents are investing in their markets and are allowed to cooperate through excha...

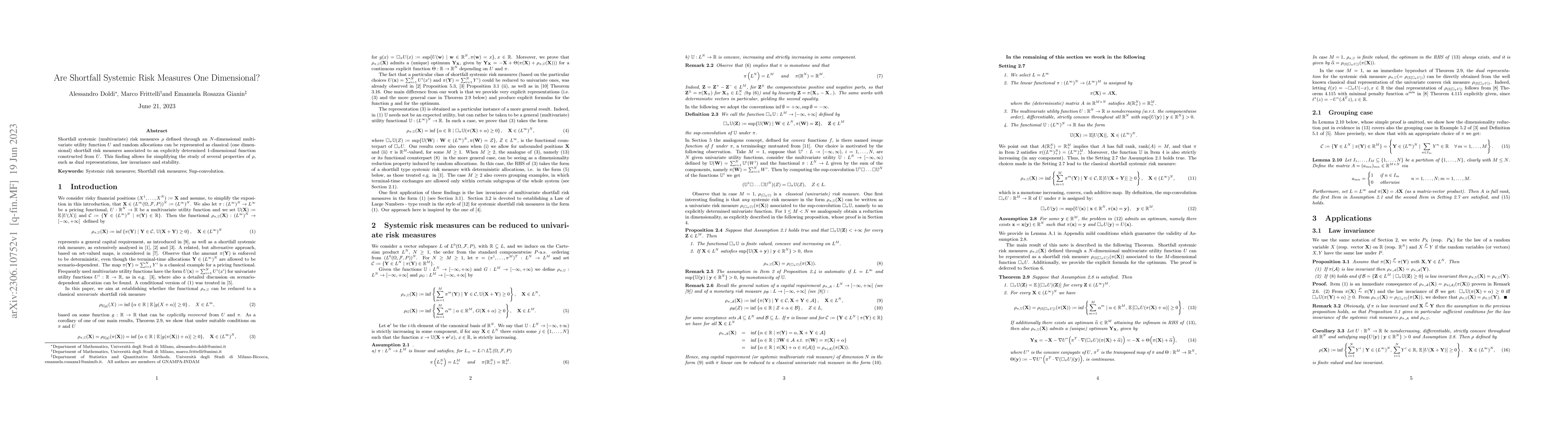

Are Shortfall Systemic Risk Measures One Dimensional?

Shortfall systemic (multivariate) risk measures $\rho$ defined through an $N$-dimensional multivariate utility function $U$ and random allocations can be represented as classical (one dimensional) s...

Multivariate Systemic Risk Measures and Computation by Deep Learning Algorithms

In this work we propose deep learning-based algorithms for the computation of systemic shortfall risk measures defined via multivariate utility functions. We discuss the key related theoretical aspe...

Collective completeness and pricing hedging duality

This paper builds on "Collective Arbitrage and the Value of Cooperation" by Biagini et al. (2025, forthcoming in "Finance and Stochastics"), which introduced in discrete time the notions of collective...