Nacira Agram

17 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Fokker-Planck equation for McKean-Vlasov SPDEs driven by time-space Brownian sheet

In this paper, we consider a McKean-Vlasov (mean-field) stochastic partial differential equations (SPDEs) driven by a Brownian sheet. We study the propagation of chaos for a space-time Ornstein-Uhle...

Optimal control of SPDEs driven by time-space Brownian motion

In this paper we study a Pontryagin type stochastic maximum principle for the optimal control of a system, where the state dynamics satisfy a stochastic partial differential equation (SPDE) driven b...

The Donsker delta function and local time for McKean-Vlasov processes and applications

The purpose of this paper is to establish a stochastic differential equation for the Donsker delta measure of the solution of a McKean-Vlasov (mean-field) stochastic differential equation. If the ...

Impulse control of conditional McKean-Vlasov jump diffusions

This paper establishes a verification theorem for impulse control problems involving conditional McKean-Vlasov jump diffusions. We obtain a Markovian system by combining the state equation of the pr...

Optimal stopping of conditional McKean-Vlasov jump diffusions

We study the problem of optimal stopping of conditional McKean-Vlasov (mean-field) stochastic differential equations with jumps (conditional McKean-Vlasov jump diffusions, for short). We obtain suff...

Stochastic Fokker-Planck PIDE for conditional McKean-Vlasov jump diffusions and applications to optimal control

The purpose of this paper is to study optimal control of conditional McKean-Vlasov (mean-field) stochastic differential equations with jumps (conditional McKean-Vlasov jump diffusions, for short). T...

Deep learning for quadratic hedging in incomplete jump market

We propose a deep learning approach to study the minimal variance pricing and hedging problem in an incomplete jump diffusion market. It is based upon a rigorous stochastic calculus derivation of the ...

Fokker-Planck equations for McKean-Vlasov SDEs driven by fractional Brownian motion

In this paper, we study the probability distribution of solutions of McKean-Vlasov stochastic differential equations (SDEs) driven by fractional Brownian motion. We prove the associated Fokker-Planck ...

Installation of renewable capacities to meet emission targets and demand under uncertainty

This paper focuses on minimizing the costs related to renewable energy installations under emission constraints. We tackle the problem in three different cases. Assuming intervening once, we determine...

SIG-BSDE for Dynamic Risk Measures

In this paper, we consider dynamic risk measures induced by backward stochastic differential equations (BSDEs). We discuss different examples that come up in the literature, including the entropic ris...

A Kalman filter for linear systems driven by time-space Brownian sheet

We study a linear filtering problem where the signal and observation processes are described as solutions of linear stochastic differential equations driven by time-space Brownian sheets. We derive a ...

Fokker-Planck equations for conditional McKean-Vlasov systems driven by Brownian sheets

We investigate conditional McKean-Vlasov equations driven by time-space white noise, motivated by the propagation of chaos in an N-particle system with space-time Ornstein-Uhlenbeck dynamics. The fram...

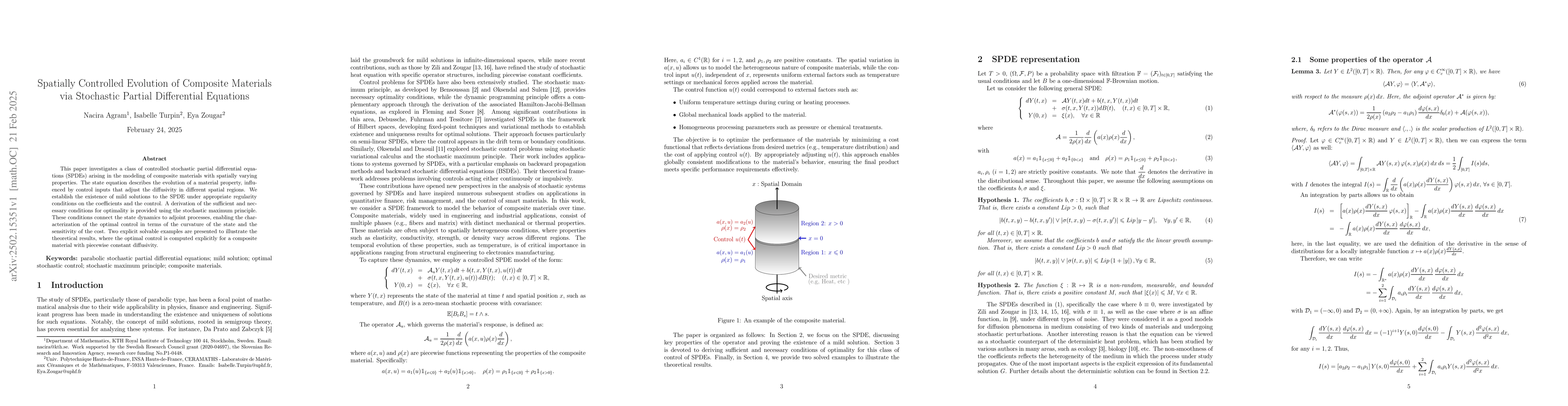

Spatially Controlled Evolution of Composite Materials via Stochastic Partial Differential Equations

This paper investigates a class of controlled stochastic partial differential equations (SPDEs) arising in the modeling of composite materials with spatially varying properties. The state equation des...

SPDE Games Driven by a Brownian Sheet with Applications to Pollution Minimization

This paper studies a nonzero-sum stochastic differential game in the context of shared spatial-domain pollution control. The pollution dynamics are governed by a stochastic partial differential equati...

Deep Learning for Energy Market Contracts: Dynkin Game with Doubly RBSDEs

This paper examines a Contract for Difference (CfD) with early exit options, a widely used risk management instrument in electricity markets. The contract involves a producer and a regulatory entity, ...

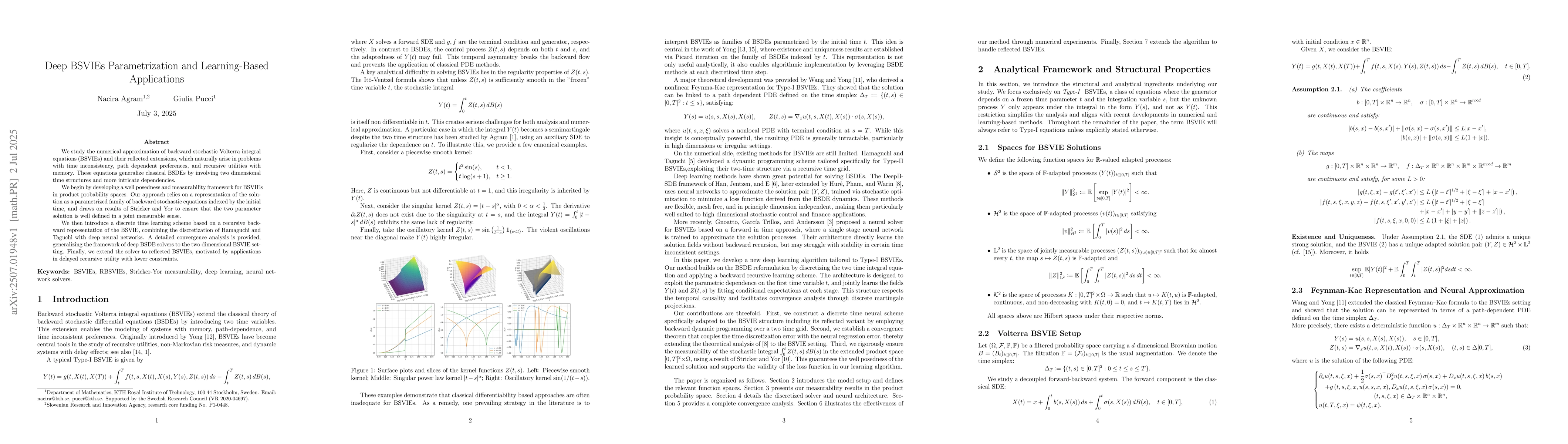

Deep BSVIEs Parametrization and Learning-Based Applications

We study the numerical approximation of backward stochastic Volterra integral equations (BSVIEs) and their reflected extensions, which naturally arise in problems with time inconsistency, path depende...

A Deep Learning Approach to Renewable Capacity Installation under Jump Uncertainty

We study a stochastic model for the installation of renewable energy capacity under demand uncertainty and jump driven dynamics. The system is governed by a multidimensional Ornstein-Uhlenbeck (OU) pr...