Olivier Scaillet

7 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Sparse spanning portfolios and under-diversification with second-order stochastic dominance

We develop and implement methods for determining whether relaxing sparsity constraints on portfolios improves the investment opportunity set for risk-averse investors. We formulate a new estimation ...

Latent Factor Analysis in Short Panels

We develop inferential tools for latent factor analysis in short panels. The pseudo maximum likelihood setting under a large cross-sectional dimension n and a fixed time series dimension T relies on...

Eigenvalue tests for the number of latent factors in short panels

This paper studies new tests for the number of latent factors in a large cross-sectional factor model with small time dimension. These tests are based on the eigenvalues of variance-covariance matri...

A penalized two-pass regression to predict stock returns with time-varying risk premia

We develop a penalized two-pass regression with time-varying factor loadings. The penalization in the first pass enforces sparsity for the time-variation drivers while also maintaining compatibility...

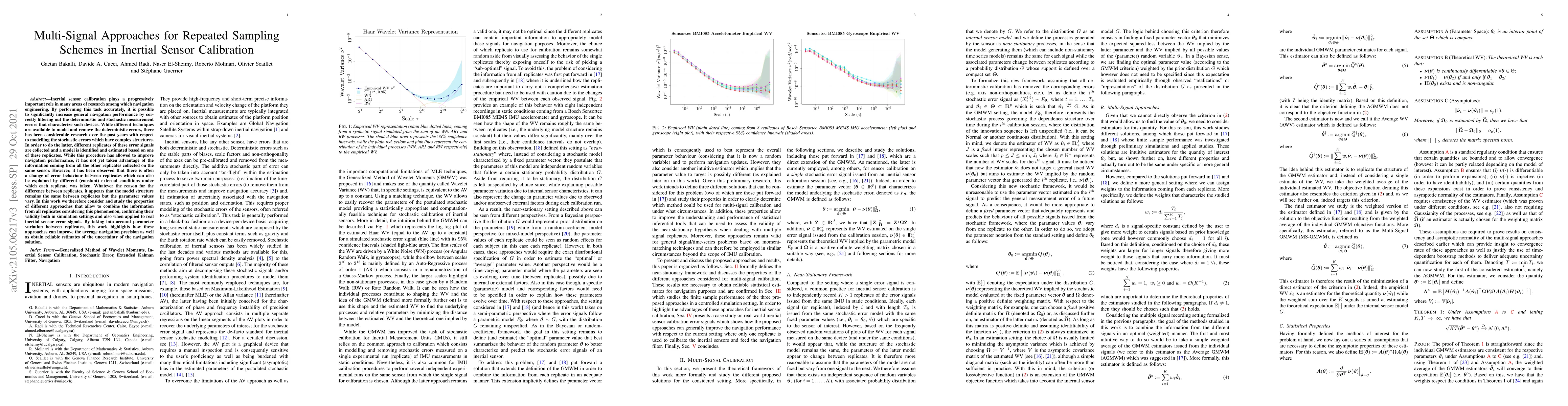

Multi-Signal Approaches for Repeated Sampling Schemes in Inertial Sensor Calibration

Inertial sensor calibration plays a progressively important role in many areas of research among which navigation engineering. By performing this task accurately, it is possible to significantly inc...

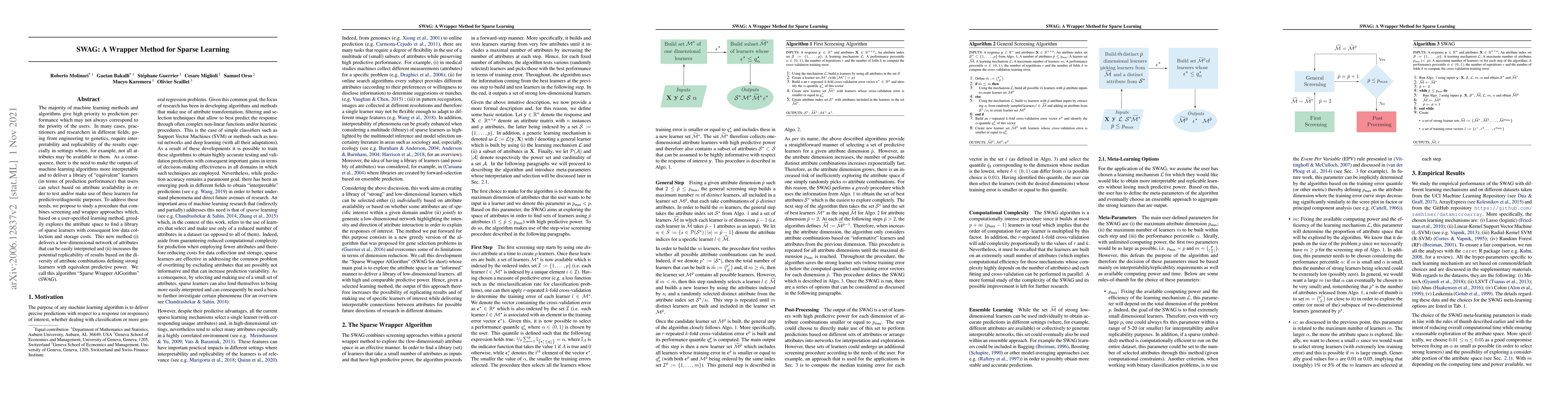

SWAG: A Wrapper Method for Sparse Learning

The majority of machine learning methods and algorithms give high priority to prediction performance which may not always correspond to the priority of the users. In many cases, practitioners and re...

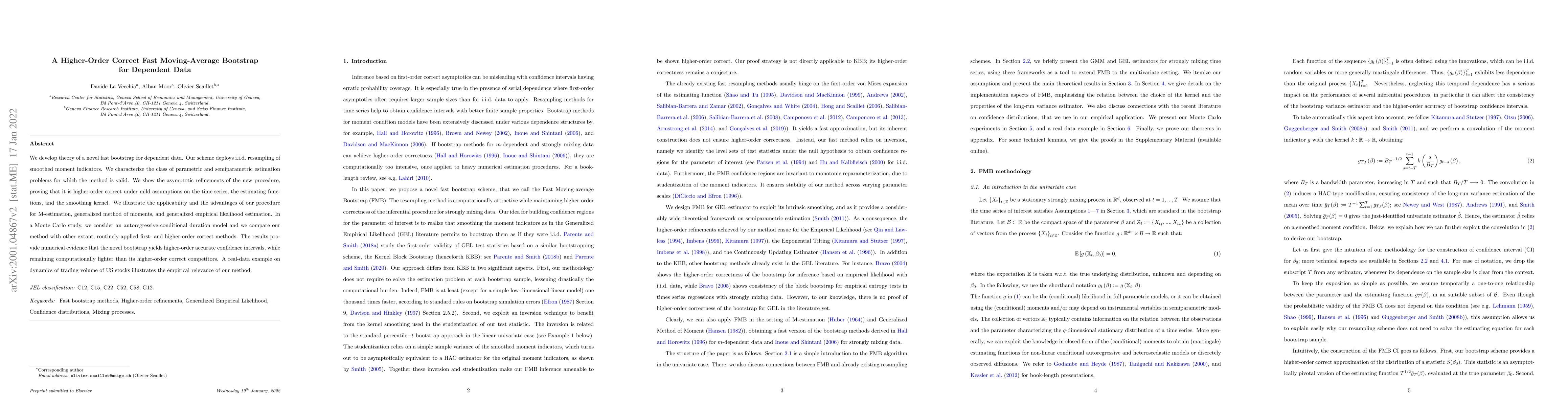

A Higher-Order Correct Fast Moving-Average Bootstrap for Dependent Data

We develop and implement a novel fast bootstrap for dependent data. Our scheme is based on the i.i.d. resampling of the smoothed moment indicators. We characterize the class of parametric and semi-p...