Wenyuan Wang

24 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Continual Learning of Large Language Models: A Comprehensive Survey

The recent success of large language models (LLMs) trained on static, pre-collected, general datasets has sparked numerous research directions and applications. One such direction addresses the non-tr...

Multimodal Needle in a Haystack: Benchmarking Long-Context Capability of Multimodal Large Language Models

Multimodal Large Language Models (MLLMs) have shown significant promise in various applications, leading to broad interest from researchers and practitioners alike. However, a comprehensive evaluation...

Multi-Vehicle Trajectory Planning at V2I-enabled Intersections based on Correlated Equilibrium

Generating trajectories that ensure both vehicle safety and improve traffic efficiency remains a challenging task at intersections. Many existing works utilize Nash equilibrium (NE) for the trajecto...

Value Maximization under Stochastic Quasi-Hyperbolic Discounting

We investigate a value-maximizing problem incorporating a human behavior pattern: present-biased-ness, for a firm which navigates strategic decisions encompassing earning retention/payout and capita...

Optimal portfolio under ratio-type periodic evaluation in incomplete markets with stochastic factors

This paper studies a type of periodic utility maximization for portfolio management in an incomplete market model, where the underlying price diffusion process depends on some external stochastic fa...

Optimal Portfolio with Ratio Type Periodic Evaluation under Short-Selling Prohibition

This paper studies some unconventional utility maximization problems when the ratio type relative portfolio performance is periodically evaluated over an infinite horizon. Meanwhile, the agent is pr...

De Finetti's Control Problem with Poisson Observations under Spectrally Positive Markov Additive Process

We study a De Finetti's optimal dividend and capital injection problem under a Markov additive model. The surplus process before dividend and capital injection is assumed to follow a spectrally posi...

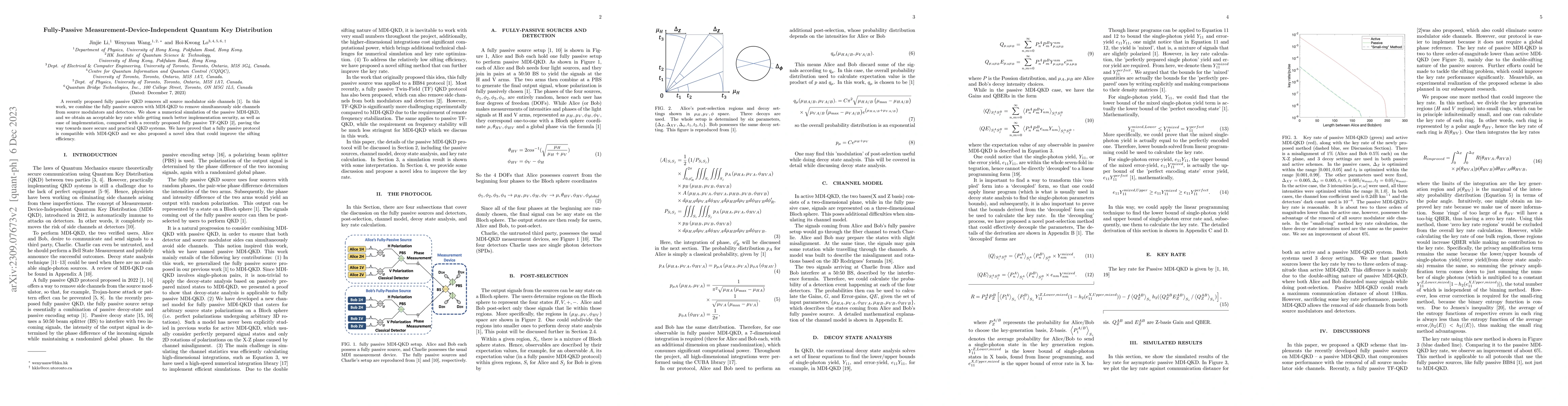

Fully Passive Measurement-Device-Independent Quantum Key Distribution

A recently proposed fully passive QKD removes all source modulator side channels. In this work, we combine the fully passive sources with MDI-QKD to remove simultaneously side channels from source m...

Fully-Passive Twin-Field Quantum Key Distribution

We propose a fully-passive twin-field quantum key distribution (QKD) setup where basis choice, decoy-state preparation and encoding are all implemented entirely by post-processing without any active...

Proof-of-Principle Demonstration of Fully-Passive Quantum Key Distribution

Quantum key distribution (QKD) offers information-theoretic security based on the fundamental laws of physics. However, device imperfections, such as those in active modulators, may introduce side-c...

Passive continuous variable quantum key distribution

Passive quantum key distribution (QKD) has been proposed for discrete variable protocols to eliminate side channels in the source. Unfortunately, the key rate of passive DV-QKD protocols suffers fro...

On De Finetti's control under Poisson observations: optimality of a double barrier strategy in a Markov additive model

In this paper we consider the De Finetti's optimal dividend and capital injection problem under a Markov additive model. We assume that the surplus process before dividends and capital injections fo...

Resource-Efficient Real-Time Polarization Compensation for MDI-QKD with Rejected Data

Measurement-device-independent quantum key distribution (MDI-QKD) closes all the security loopholes in the detection system and is a promising solution for secret key sharing. Polarization encoding ...

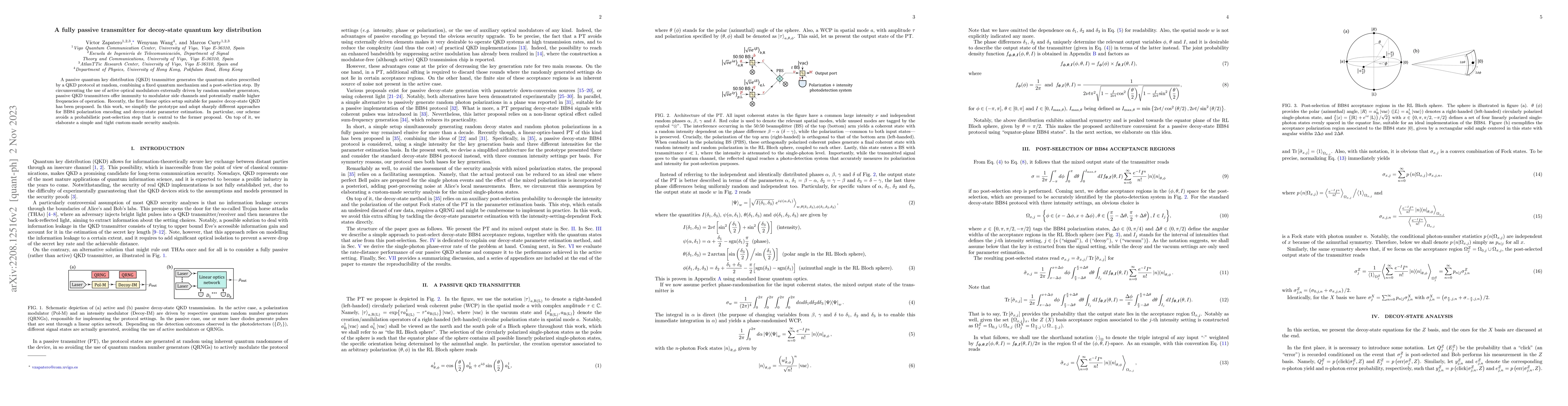

A fully passive transmitter for decoy-state quantum key distribution

A passive quantum key distribution (QKD) transmitter generates the quantum states prescribed by a QKD protocol at random, combining a fixed quantum mechanism and a post-selection step. By avoiding t...

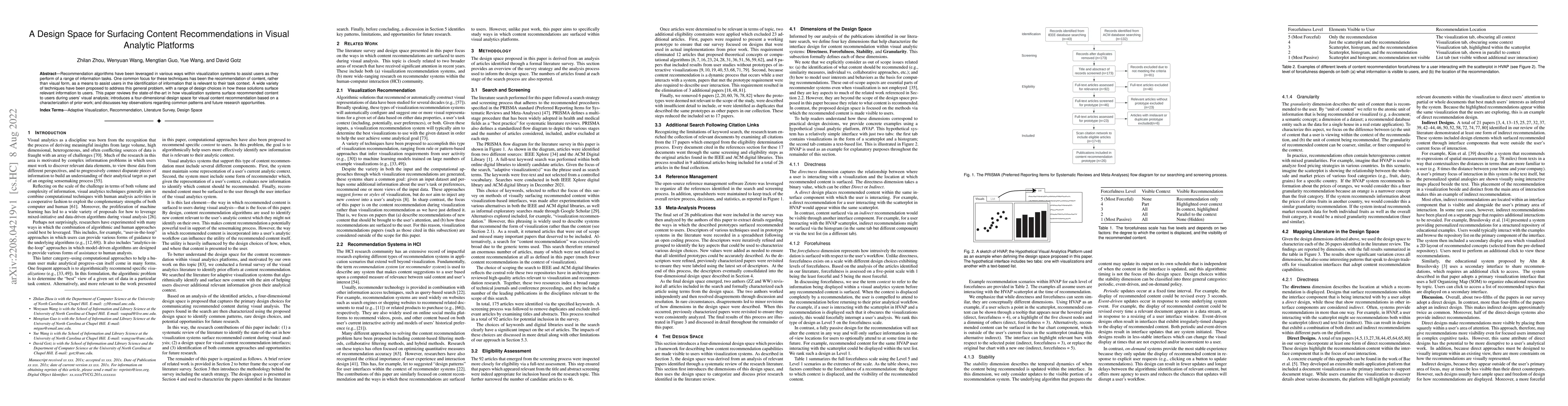

A Design Space for Surfacing Content Recommendations in Visual Analytic Platforms

Recommendation algorithms have been leveraged in various ways within visualization systems to assist users as they perform of a range of information tasks. One common focus for these techniques has ...

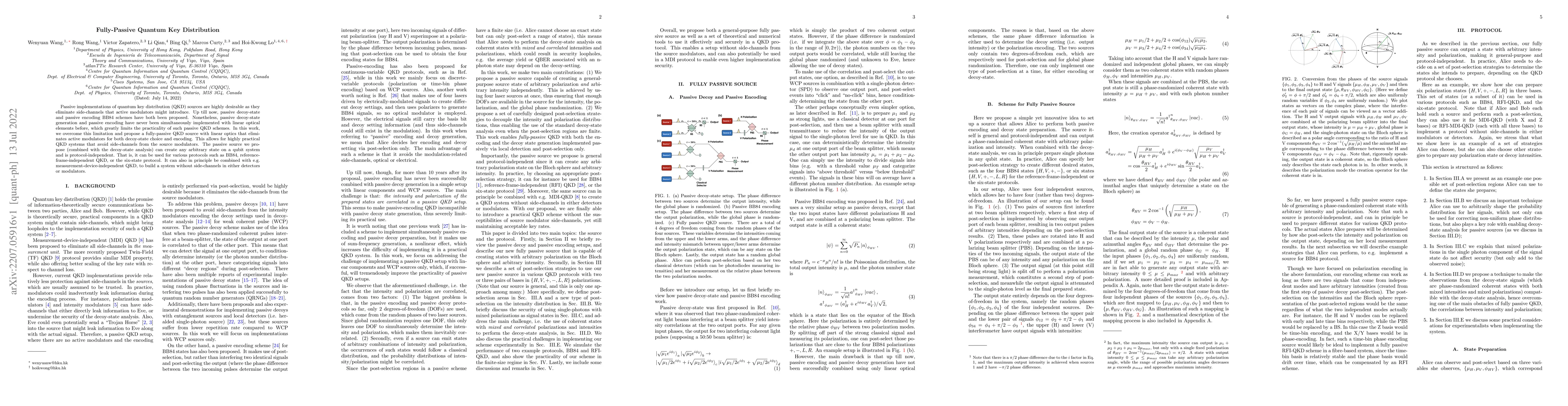

Fully-Passive Quantum Key Distribution

Passive implementations of quantum key distribution (QKD) sources are highly desirable as they eliminate side-channels that active modulators might introduce. Up till now, passive decoy-state and pa...

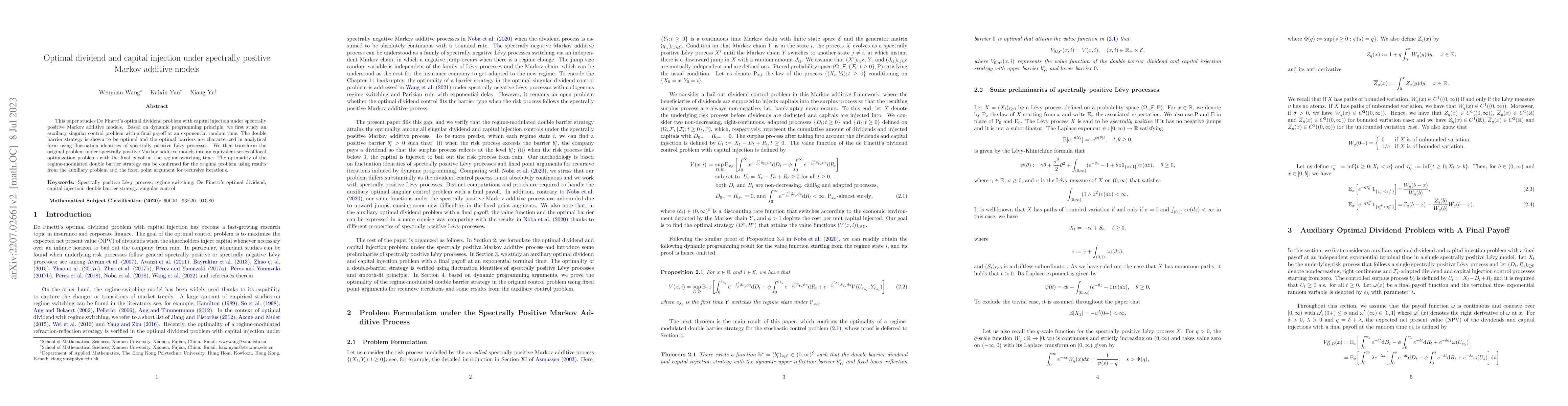

Optimal dividend and capital injection under spectrally positive Markov additive models

This paper studies De Finetti's optimal dividend problem with capital injection under spectrally positive Markov additive models. Based on dynamic programming principle, we first study an auxiliary ...

Multi-Tailed Vision Transformer for Efficient Inference

Recently, Vision Transformer (ViT) has achieved promising performance in image recognition and gradually serves as a powerful backbone in various vision tasks. To satisfy the sequential input of Tra...

On optimality of barrier dividend control under endogenous regime switching with application to Chapter 11 bankruptcy

Motivated by recent developments in risk management based on the U.S. bankruptcy code, we revisit the De Finetti's optimal dividend problem by incorporating the reorganization process and regulator'...

Experiment on scalable multi-user twin-field quantum key distribution network

Twin-field quantum key distribution (TFQKD) systems have shown great promise for implementing practical long-distance secure quantum communication due to its measurement-device-independent nature an...

Optimal portfolio under ratio-type periodic evaluation in stochastic factor models under convex trading constraints

This paper studies a type of periodic utility maximization problems for portfolio management in incomplete stochastic factor models with convex trading constraints. The portfolio performance is period...

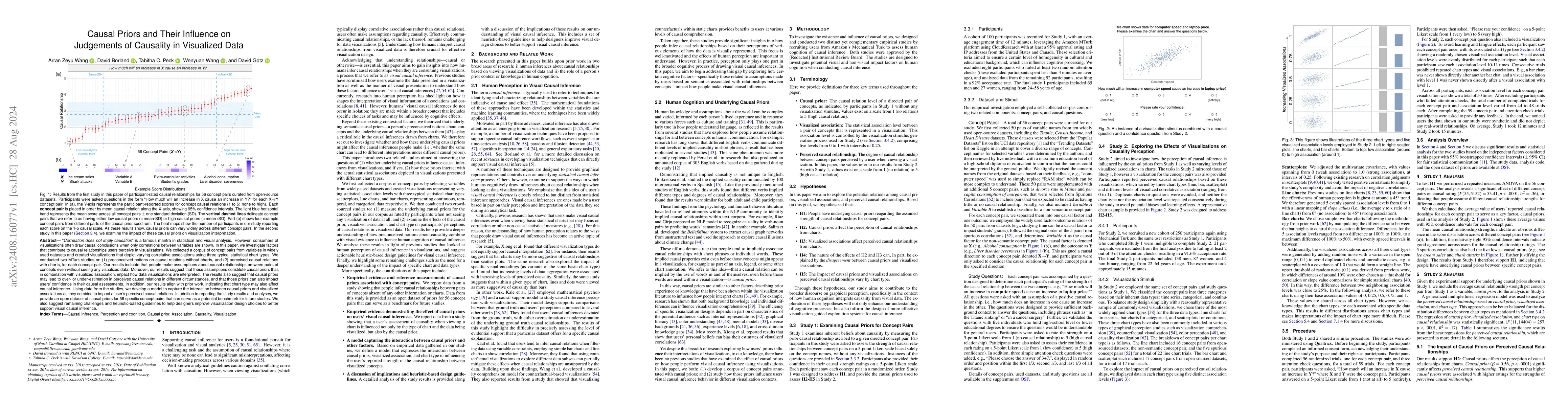

Causal Priors and Their Influence on Judgements of Causality in Visualized Data

"Correlation does not imply causation" is a famous mantra in statistical and visual analysis. However, consumers of visualizations often draw causal conclusions when only correlations between variable...

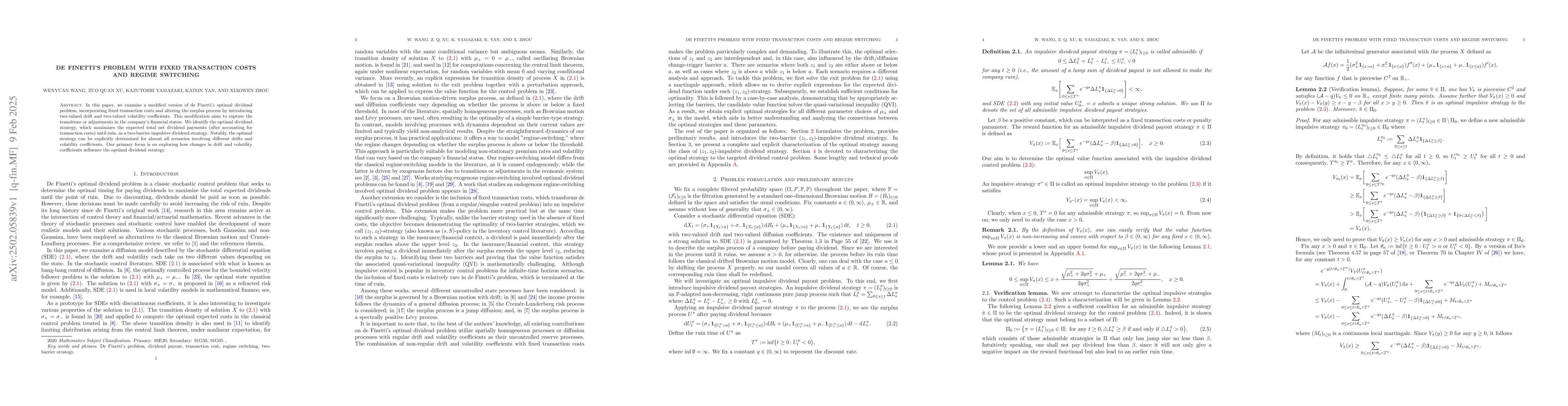

De Finetti's problem with fixed transaction costs and regime switching

In this paper, we examine a modified version of de Finetti's optimal dividend problem, incorporating fixed transaction costs and altering the surplus process by introducing two-valued drift and two-va...

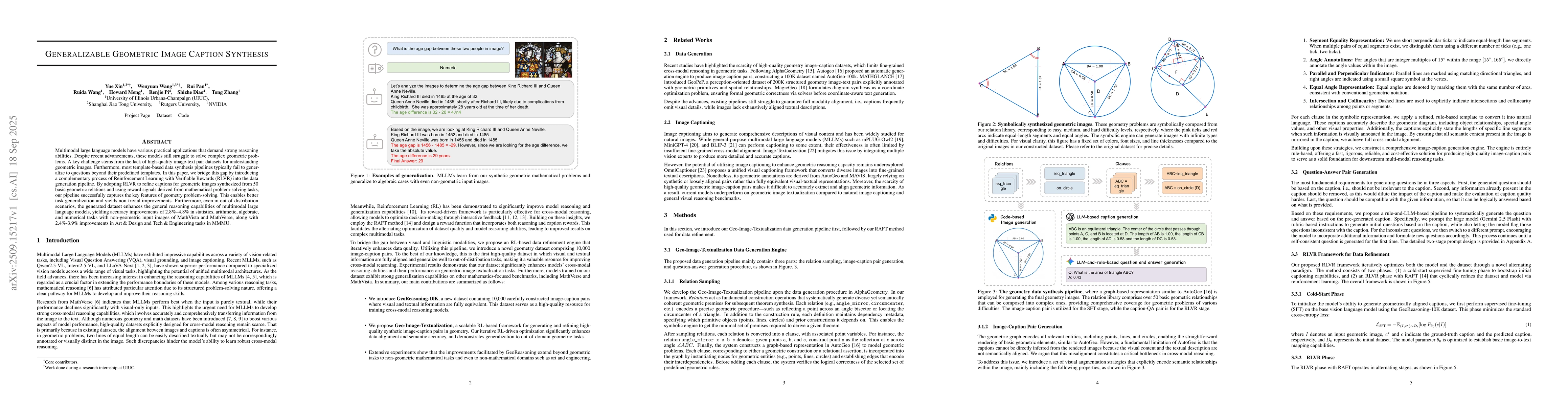

Generalizable Geometric Image Caption Synthesis

Multimodal large language models have various practical applications that demand strong reasoning abilities. Despite recent advancements, these models still struggle to solve complex geometric problem...