Xianglin Wu

1 papers on arXiv

Academic Profile

Statistics

arXiv Papers

1

Total Publications

1

Similar Authors

Papers on arXiv

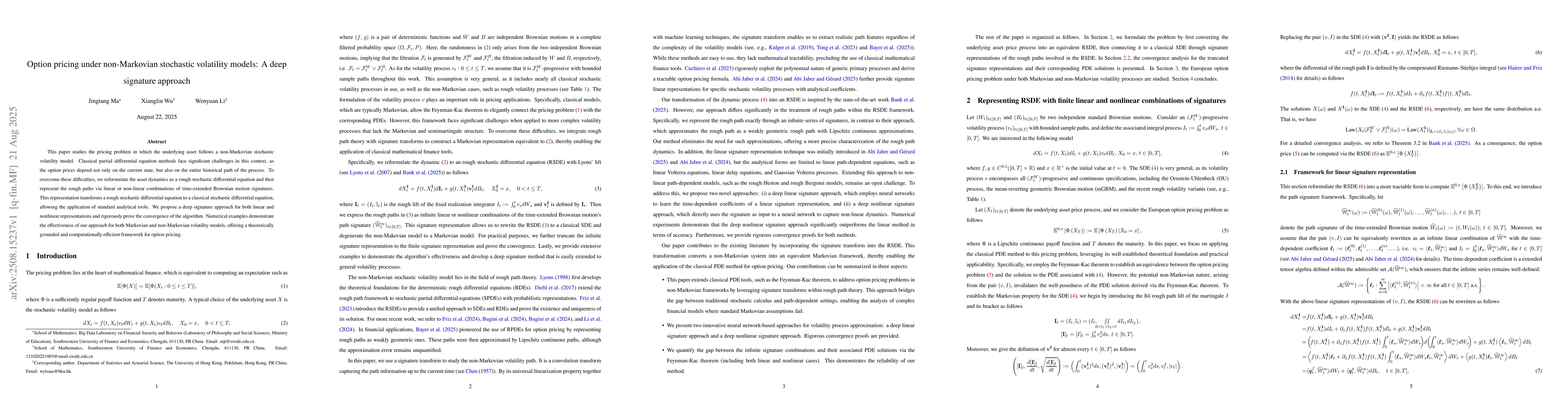

Option pricing under non-Markovian stochastic volatility models: A deep signature approach

This paper studies the pricing problem in which the underlying asset follows a non-Markovian stochastic volatility model. Classical partial differential equation methods face significant challenges in...