Xuedong He

6 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Regret Bounds for Episodic Risk-Sensitive Linear Quadratic Regulator

Risk-sensitive linear quadratic regulator is one of the most fundamental problems in risk-sensitive optimal control. In this paper, we study online adaptive control of risk-sensitive linear quadrati...

Reference-dependent asset pricing with a stochastic consumption-dividend ratio

We study a discrete-time consumption-based capital asset pricing model under expectations-based reference-dependent preferences. More precisely, we consider an endowment economy populated by a repre...

Regret Bounds for Markov Decision Processes with Recursive Optimized Certainty Equivalents

The optimized certainty equivalent (OCE) is a family of risk measures that cover important examples such as entropic risk, conditional value-at-risk and mean-variance models. In this paper, we propo...

Convergence of Simulated Annealing Using Kinetic Langevin Dynamics

We study the simulated annealing algorithm based on the kinetic Langevin dynamics, in order to find the global minimum of a non-convex potential function. For both the continuous time formulation an...

Improving Model Drift for Robust Object Tracking

Discriminative correlation filters show excellent performance in object tracking. However, in complex scenes, the apparent characteristics of the tracked target are variable, which makes it easy to ...

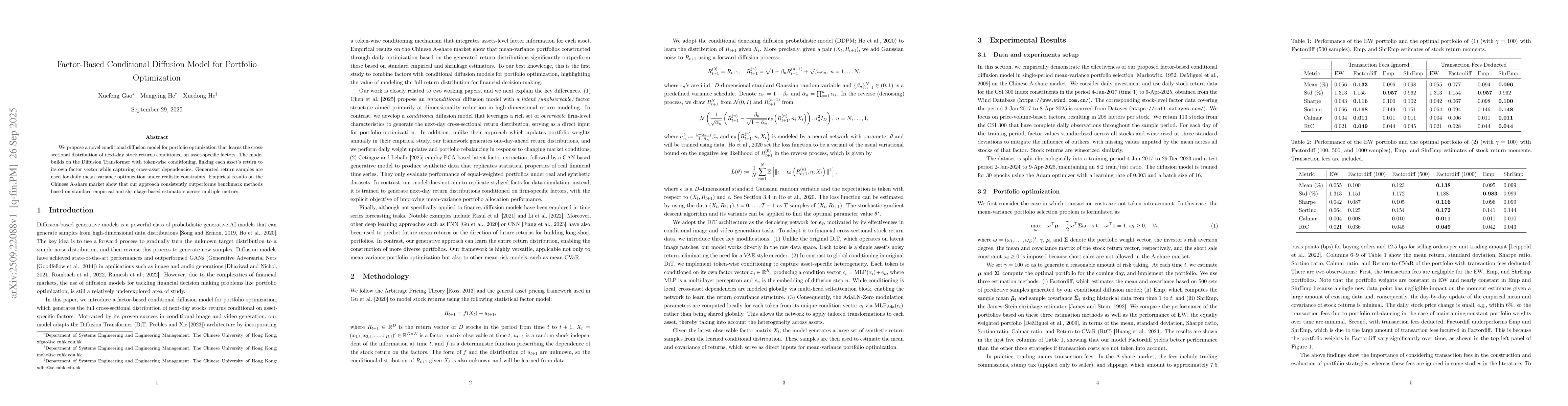

Factor-Based Conditional Diffusion Model for Portfolio Optimization

We propose a novel conditional diffusion model for portfolio optimization that learns the cross-sectional distribution of next-day stock returns conditioned on asset-specific factors. The model builds...