Yuyu Chen

11 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Sub-uniformity of harmonic mean p-values

We obtain several inequalities on the generalized means of dependent p-values. In particular, the weighted harmonic mean of p-values is strictly sub-uniform under several dependence assumptions of p...

Dominance between combinations of infinite-mean Pareto random variables

We study stochastic dominance between portfolios of independent and identically distributed (iid) extremely heavy-tailed (i.e., infinite-mean) Pareto random variables. With the notion of majorizatio...

Risk exchange under infinite-mean Pareto models

We study the optimal decisions of agents who aim to minimize their risks by allocating their positions over extremely heavy-tailed (i.e., infinite-mean) and possibly dependent losses. The loss distr...

An unexpected stochastic dominance: Pareto distributions, dependence, and diversification

We find the perhaps surprising inequality that the weighted average of independent and identically distributed Pareto random variables with infinite mean is larger than one such random variable in t...

Infinite-mean models in risk management: Discussions and recent advances

In statistical analysis, many classic results require the assumption that models have finite mean or variance, including the most standard versions of the laws of large numbers and the central limit t...

Optimal insurance design with Lambda-Value-at-Risk

This paper explores optimal insurance solutions based on the Lambda-Value-at-Risk ($\Lambda\VaR$). If the expected value premium principle is used, our findings confirm that, similar to the VaR model,...

Stochastic dominance for linear combinations of infinite-mean risks

In this paper, we establish a sufficient condition to compare linear combinations of independent and identically distributed (iid) infinite-mean random variables under usual stochastic order. We intro...

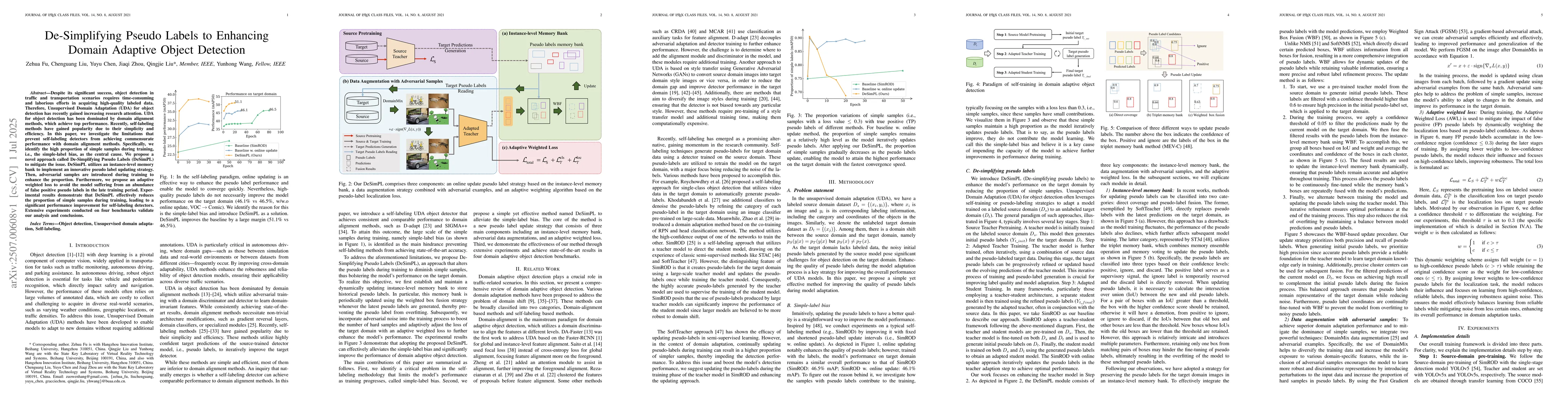

De-Simplifying Pseudo Labels to Enhancing Domain Adaptive Object Detection

Despite its significant success, object detection in traffic and transportation scenarios requires time-consuming and laborious efforts in acquiring high-quality labeled data. Therefore, Unsupervised ...

Gradient boosted multi-population mortality modelling with high-frequency data

High-frequency mortality data remains an understudied yet critical research area. While its analysis can reveal short-term health impacts of climate extremes and enable more timely mortality forecasts...

Understanding Inconsistent State Update Vulnerabilities in Smart Contracts

Smart contracts enable contract terms to be automatically executed and verified on the blockchain, and recent years have witnessed numerous applications of them in areas such as financial institutions...

Fine-Tuned Language Models for Domain-Specific Summarization and Tagging

This paper presents a pipeline integrating fine-tuned large language models (LLMs) with named entity recognition (NER) for efficient domain-specific text summarization and tagging. The authors address...