Summary

Using a 100-day symmetric window around the January 2025 U.S. presidential inauguration, non-parametric statistical methods with bootstrap resampling (10,000 iterations) analyze distributional properties and anomalies. Results indicate a statistically significant 3.61\% Indonesian rupiah depreciation post-inauguration, with a large effect size (Cliff's Delta $= -0.9224$, CI: $[-0.9727, -0.8571]$). Central tendency shifted markedly, yet volatility remained stable (variance ratio $= 0.9061$, $p = 0.504$). Four significant anomalies exhibiting temporal clustering are detected. These findings provide quantitative evidence of political transition effects on emerging market currencies, highlighting implications for monetary policy and currency risk management.

AI Key Findings

Generated Sep 03, 2025

Methodology

The study employs a robust non-parametric statistical framework, utilizing bootstrap resampling (10,000 iterations) and multiple non-parametric tests to analyze USD/IDR exchange rate dynamics around the 2025 U.S. presidential inauguration within a 100-day symmetric window.

Key Results

- A statistically significant 3.61% Indonesian rupiah depreciation post-inauguration with a large effect size (Cliff's Delta = -0.9224, CI: [-0.9727, -0.8571]).

- Central tendency shifted markedly, yet volatility remained stable (variance ratio = 0.9061, p = 0.504).

- Four significant anomalies exhibiting temporal clustering detected.

Significance

This research provides quantitative evidence of political transition effects on emerging market currencies, with implications for monetary policy and currency risk management.

Technical Contribution

The methodological approach, combining multiple non-parametric tests with bootstrap resampling, offers confidence in the robustness of the results, effectively addressing distributional irregularities common in financial time series, especially during periods of structural change.

Novelty

This study distinguishes itself by employing a comprehensive non-parametric statistical framework to analyze the impact of U.S. presidential transitions on emerging market currencies, providing quantifiable evidence of political risk transmission in global currency markets.

Limitations

- The 100-day symmetric window might not capture longer-term adjustment processes.

- The focus on a single currency pair limits generalizability across the broader emerging market currency landscape.

- Isolating the specific impact of the presidential transition from concurrent economic factors presents inherent challenges.

Future Work

- Extend the statistical framework to a multi-currency panel analysis to identify systematic patterns across emerging market currencies.

- Investigate the relationship between specific policy announcements and detected anomalies to gain deeper insights into transmission mechanisms.

Paper Details

PDF Preview

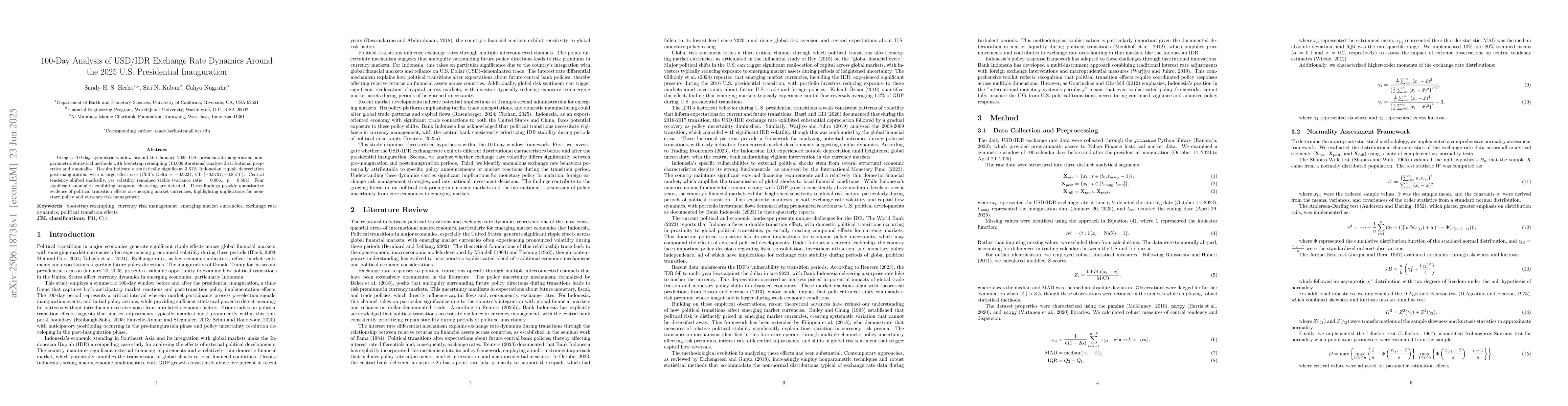

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPolitics in Public Health: Growing Partisan Divides in COVID-19 Vaccine Attitudes and Uptake Post-2021 Presidential Inauguration.

Zhang, Qi, Zhou, Zhongliang, Fan, Hongbin et al.

Characterization of the presidential inauguration speech and identification of political communities in Colombia: An empirical approach from the analysis of social networks

Juan Sosa, Carolina Luque, Isabella Agudelo et al.

No citations found for this paper.

Comments (0)