Summary

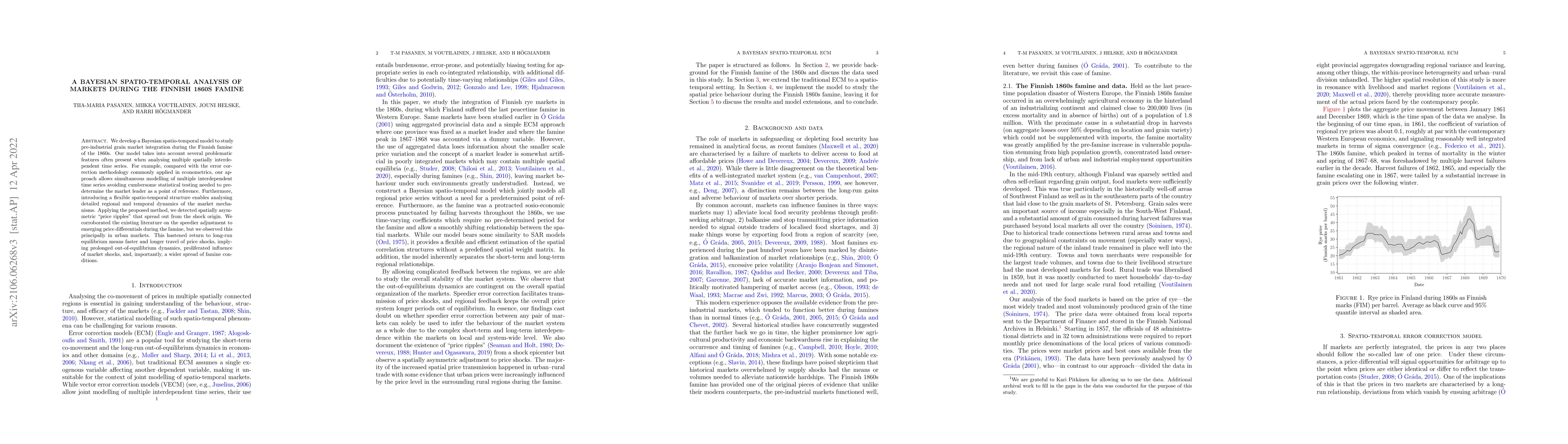

We develop a Bayesian spatio-temporal model to study pre-industrial grain market integration during the Finnish famine of the 1860s. Our model takes into account several problematic features often present when analysing multiple spatially interdependent time series. For example, compared with the error correction methodology commonly applied in econometrics, our approach allows simultaneous modelling of multiple interdependent time series avoiding cumbersome statistical testing needed to predetermine the market leader as a point of reference. Furthermore, introducing a flexible spatio-temporal structure enables analysing detailed regional and temporal dynamics of the market mechanisms. Applying the proposed method, we detected spatially asymmetric "price ripples" that spread out from the shock origin. We corroborated the existing literature on the speedier adjustment to emerging price differentials during the famine, but we observed this principally in urban markets. This hastened return to long-run equilibrium means faster and longer travel of price shocks, implying prolonged out-of-equilibrium dynamics, proliferated influence of market shocks, and, importantly, a wider spread of famine conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian spatio-temporal models for stream networks

Kerrie Mengersen, Edgar Santos-Fernandez, James McGree et al.

No citations found for this paper.

Comments (0)