Summary

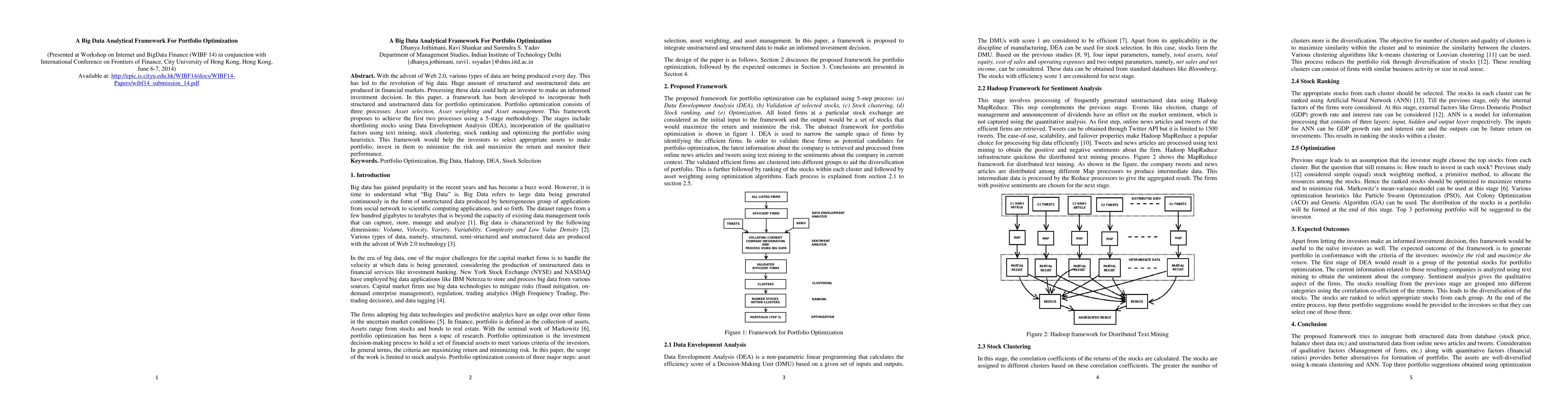

With the advent of Web 2.0, various types of data are being produced every day. This has led to the revolution of big data. Huge amount of structured and unstructured data are produced in financial markets. Processing these data could help an investor to make an informed investment decision. In this paper, a framework has been developed to incorporate both structured and unstructured data for portfolio optimization. Portfolio optimization consists of three processes: Asset selection, Asset weighting and Asset management. This framework proposes to achieve the first two processes using a 5-stage methodology. The stages include shortlisting stocks using Data Envelopment Analysis (DEA), incorporation of the qualitative factors using text mining, stock clustering, stock ranking and optimizing the portfolio using heuristics. This framework would help the investors to select appropriate assets to make portfolio, invest in them to minimize the risk and maximize the return and monitor their performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Unified Framework for Fast Large-Scale Portfolio Optimization

Abolfazl Safikhani, Pawel Polak, Weichuan Deng et al.

DeltaHedge: A Multi-Agent Framework for Portfolio Options Optimization

Jarosław A. Chudziak, Feliks Bańka

| Title | Authors | Year | Actions |

|---|

Comments (0)