Summary

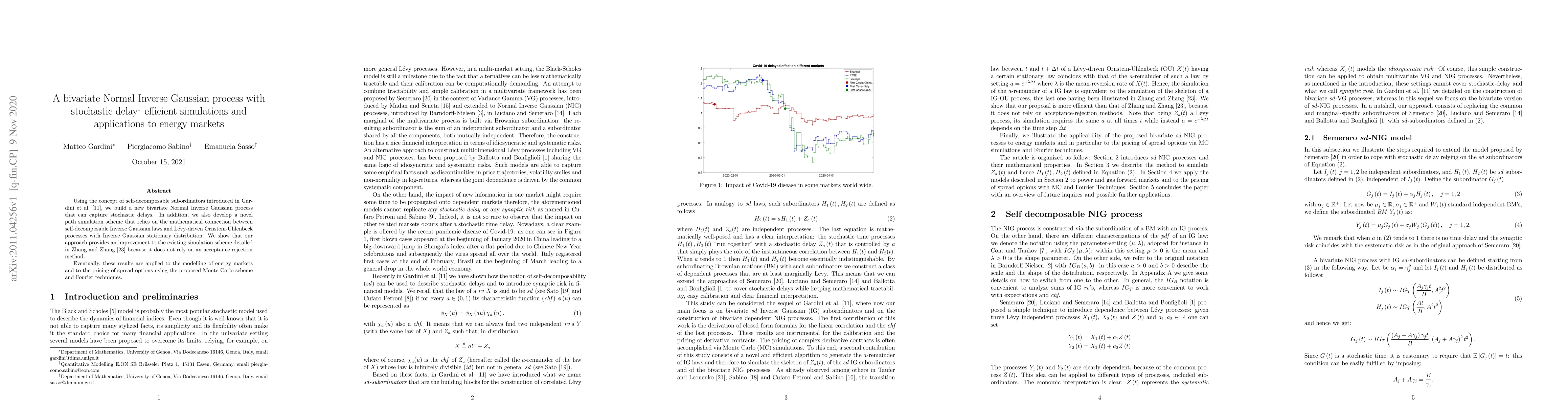

Using the concept of self-decomposable subordinators introduced in Gardini et al. [11], we build a new bivariate Normal Inverse Gaussian process that can capture stochastic delays. In addition, we also develop a novel path simulation scheme that relies on the mathematical connection between self-decomposable Inverse Gaussian laws and L\'evy-driven Ornstein-Uhlenbeck processes with Inverse Gaussian stationary distribution. We show that our approach provides an improvement to the existing simulation scheme detailed in Zhang and Zhang [23] because it does not rely on an acceptance-rejection method. Eventually, these results are applied to the modelling of energy markets and to the pricing of spread options using the proposed Monte Carlo scheme and Fourier techniques

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Variance Gamma++ Process and Applications to Energy Markets

M. Gardini, P. Sabino, E. Sasso

Constrained Bayesian Optimization under Bivariate Gaussian Process with Application to Cure Process Optimization

Gang Li, Qiong Zhang, Yezhuo Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)