Authors

Summary

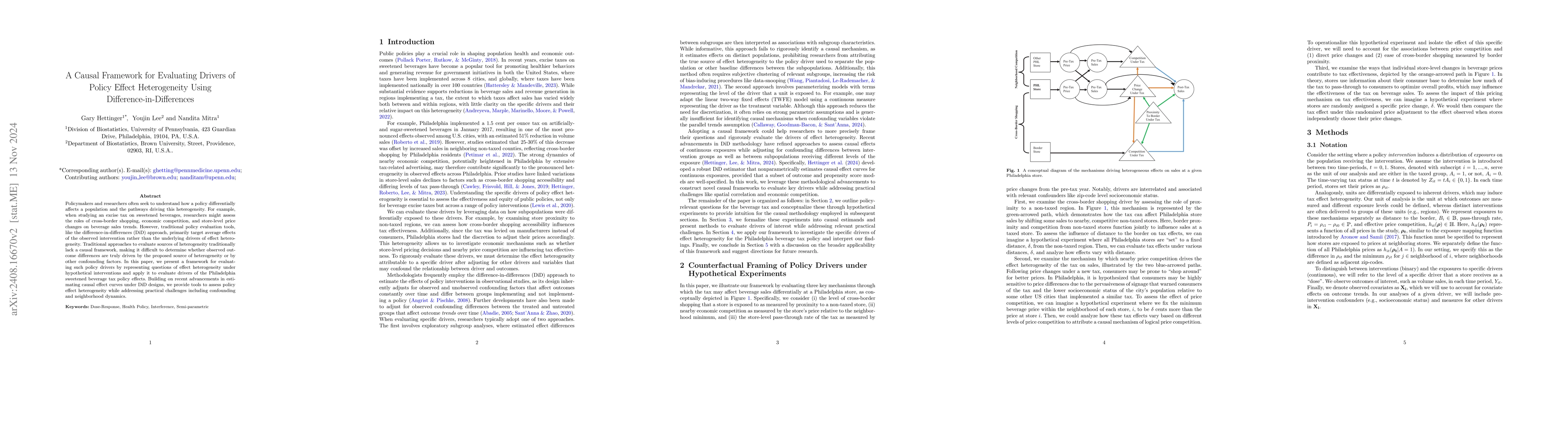

Policymakers and researchers often seek to understand how a policy differentially affects a population and the pathways driving this heterogeneity. For example, when studying an excise tax on sweetened beverages, researchers might assess the roles of cross-border shopping, economic competition, and store-level price changes on beverage sales trends. However, traditional policy evaluation tools, like the difference-in-differences (DiD) approach, primarily target average effects of the observed intervention rather than the underlying drivers of effect heterogeneity. Traditional approaches to evaluate sources of heterogeneity traditionally lack a causal framework, making it difficult to determine whether observed outcome differences are truly driven by the proposed source of heterogeneity or by other confounding factors. In this paper, we present a framework for evaluating such policy drivers by representing questions of effect heterogeneity under hypothetical interventions and apply it to evaluate drivers of the Philadelphia sweetened beverage tax policy effects. Building on recent advancements in estimating causal effect curves under DiD designs, we provide tools to assess policy effect heterogeneity while addressing practical challenges including confounding and neighborhood dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMachine Learning for Staggered Difference-in-Differences and Dynamic Treatment Effect Heterogeneity

Martin Huber, Julia Hatamyar, Noemi Kreif et al.

Multiply Robust Difference-in-Differences Estimation of Causal Effect Curves for Continuous Exposures

Youjin Lee, Gary Hettinger, Nandita Mitra

A Universal Difference-in-Differences Approach for Causal Inference

Eric Tchetgen Tchetgen, Chan Park

No citations found for this paper.

Comments (0)