Summary

CDS options allow investors to express a view on spread volatility and obtain a wider range of payoffs than are possible with vanilla CDS. We give a detailed exposition of different types of single-name CDS option, including options with upfront protection payment, recovery options and recovery swaps, and also presents a new formula for the index option. The emphasis is on using the Black-76 formula where possible and ensuring consistency within asset classes. In the framework shown here the `armageddon event' does not require special attention.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

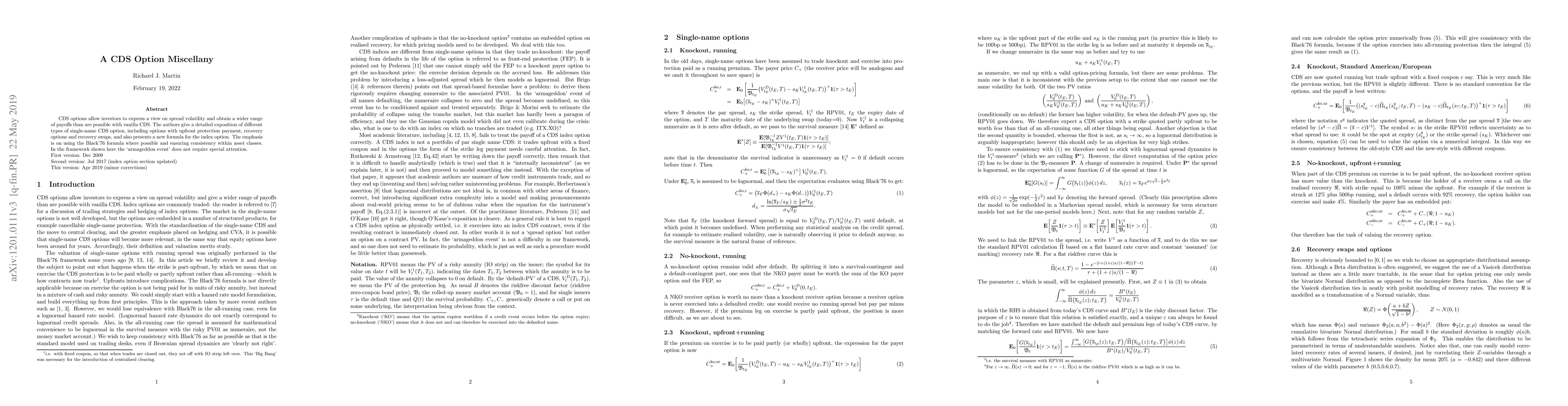

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)