Authors

Summary

We study the limiting distribution of a volatility target index as the discretisation time step converges to zero. Two limit theorems (a strong law of large numbers and a central limit theorem) are established, and as an application, the exact limiting distribution is derived. We demonstrate that the volatility of the limiting distribution is consistently larger than the target volatility, and converges to the target volatility as the observation-window parameter $\lambda$ in the definition of the realised variance converges to $1$. Besides the exact formula for the drift and the volatility of the limiting distribution, their upper and lower bounds are derived. As a corollary of the exact limiting distribution, we obtain a vega conversion formula which converts the rho sensitivity of a financial derivative on the limiting diffusion to the vega sensitivity of the same financial derivative on the underlying of the volatility target index.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper employs stochastic analysis and central limit theorems to study the limiting distribution of a volatility target index as the discretization time step converges to zero.

Key Results

- Two limit theorems, a strong law of large numbers and a central limit theorem, are established for the volatility target index.

- The exact limiting distribution is derived, showing that its volatility is consistently larger than the target volatility and converges to the target volatility as the observation-window parameter λ approaches 1.

- Bounds for the drift and volatility of the limiting distribution are derived as a corollary.

- A vega conversion formula is obtained, converting the rho sensitivity of a financial derivative on the limiting diffusion to the vega sensitivity on the underlying of the volatility target index.

Significance

This research is significant as it provides a theoretical framework for understanding the behavior of volatility target indices, which are crucial in financial modeling and risk management.

Technical Contribution

The paper presents novel central limit theorems and a detailed analysis of the limiting distribution of volatility target indices, providing a solid theoretical foundation for their use in financial applications.

Novelty

The work distinguishes itself by combining a central limit theorem with the specific context of volatility target indices, offering insights into their asymptotic behavior that are not readily available in existing literature.

Limitations

- The paper focuses on theoretical derivations and does not include empirical validation.

- The analysis assumes specific conditions and functional forms for volatility and interest rate processes.

Future Work

- Further research could investigate the empirical performance of volatility target indices under different market conditions.

- Exploring the application of these findings in practical financial modeling and trading strategies could be beneficial.

Paper Details

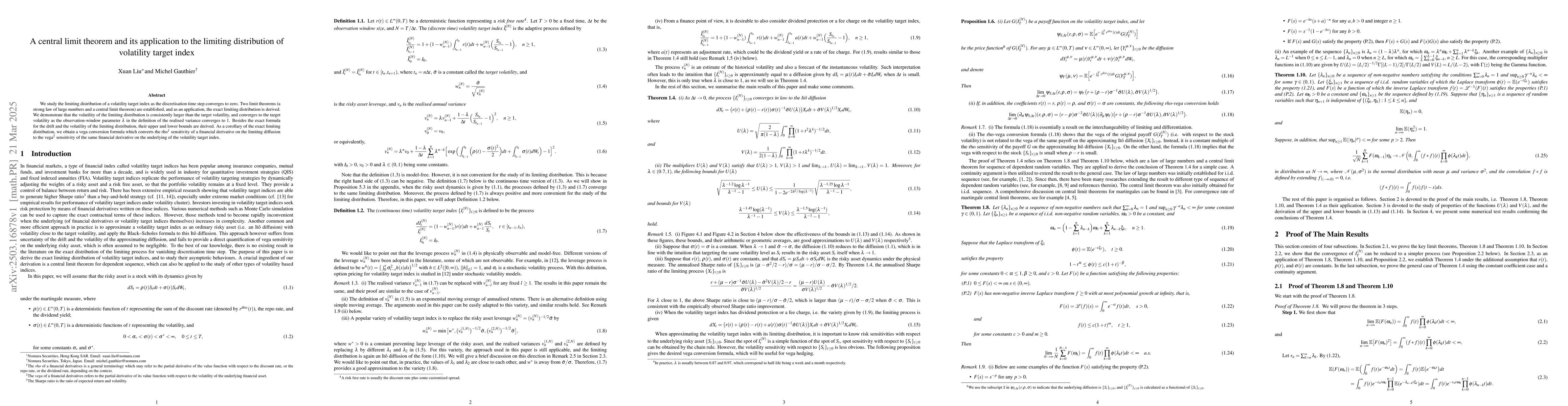

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)