Summary

If a given aggregate process $S$ is a compound mixed renewal process under a probability measure $P$, we provide a characterization of all probability measures $Q$ on the domain of $P$ such that $Q$ and $P$ are progressively equivalent and $S$ is converted into a compound mixed Poisson process under $Q$. This result extends earlier works of Delbaen & Haezendonck [2], Embrechts & Meister [5], Lyberopoulos & Macheras [11], and of the authors [14]. Implications to the ruin problem and to the computation of premium calculation principles in an insurance market possessing the property of no free lunch with vanishing risk are also discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

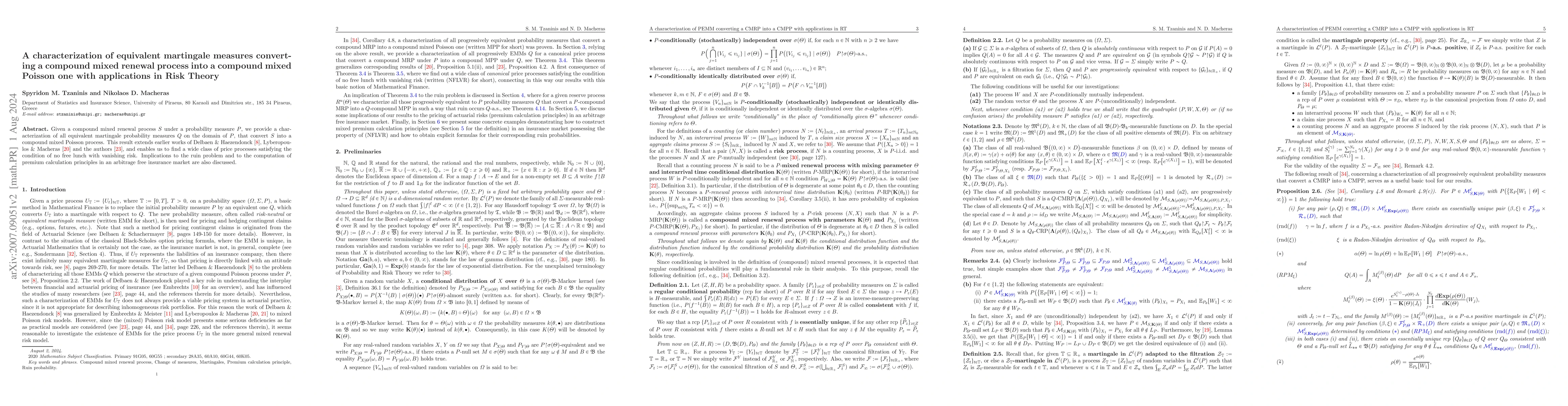

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)