Authors

Summary

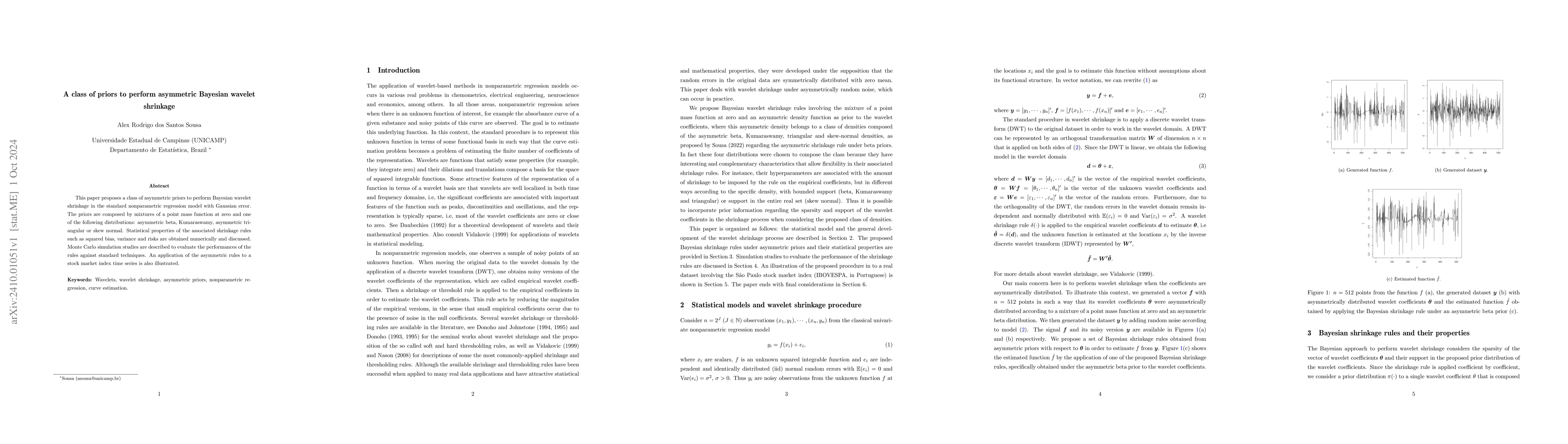

This paper proposes a class of asymmetric priors to perform Bayesian wavelet shrinkage in the standard nonparametric regression model with Gaussian error. The priors are composed by mixtures of a point mass function at zero and one of the following distributions: asymmetric beta, Kumaraswamy, asymmetric triangular or skew normal. Statistical properties of the associated shrinkage rules such as squared bias, variance and risks are obtained numerically and discussed. Monte Carlo simulation studies are described to evaluate the performances of the rules against standard techniques. An application of the asymmetric rules to a stock market index time series is also illustrated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGamma-Minimax Wavelet Shrinkage with Three-Point Priors

Dixon Vimalajeewa, Brani Vidakovic

No citations found for this paper.

Comments (0)