Summary

Multivariate dynamic time series models are widely encountered in practical studies, e.g., modelling policy transmission mechanism and measuring connectedness between economic agents. To better capture the dynamics, this paper proposes a wide class of multivariate dynamic models with time-varying coefficients, which have a general time-varying vector moving average (VMA) representation, and nest, for instance, time-varying vector autoregression (VAR), time-varying vector autoregression moving-average (VARMA), and so forth as special cases. The paper then develops a unified estimation method for the unknown quantities before an asymptotic theory for the proposed estimators is established. In the empirical study, we investigate the transmission mechanism of monetary policy using U.S. data, and uncover a fall in the volatilities of exogenous shocks. In addition, we find that (i) monetary policy shocks have less influence on inflation before and during the so-called Great Moderation, (ii) inflation is more anchored recently, and (iii) the long-run level of inflation is below, but quite close to the Federal Reserve's target of two percent after the beginning of the Great Moderation period.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

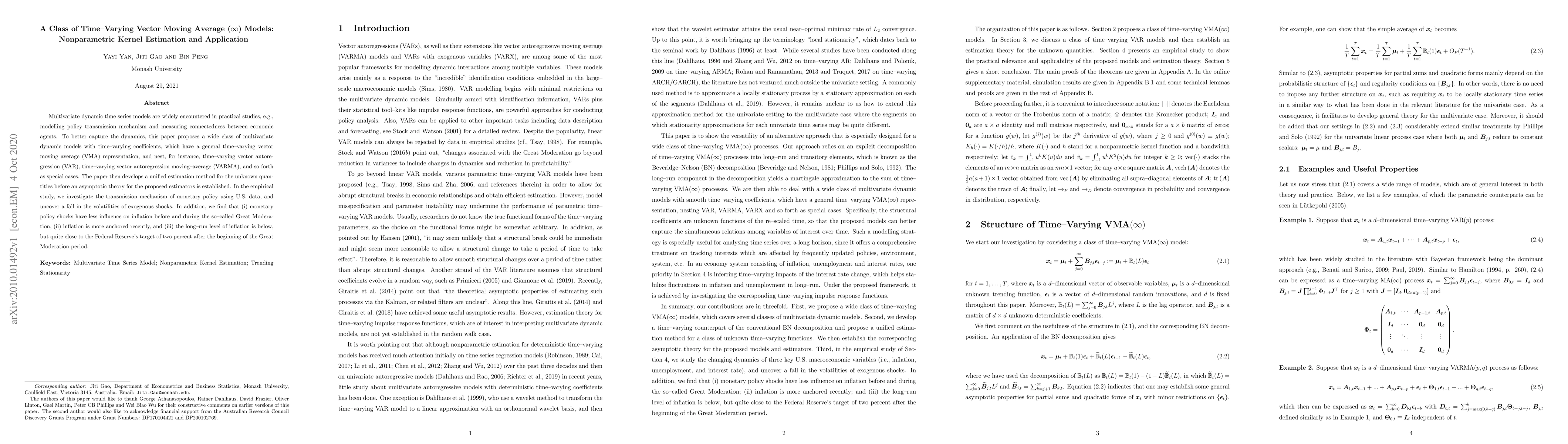

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVector AutoRegressive Moving Average Models: A Review

Ines Wilms, Marie-Christine Düker, David S. Matteson et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)