Summary

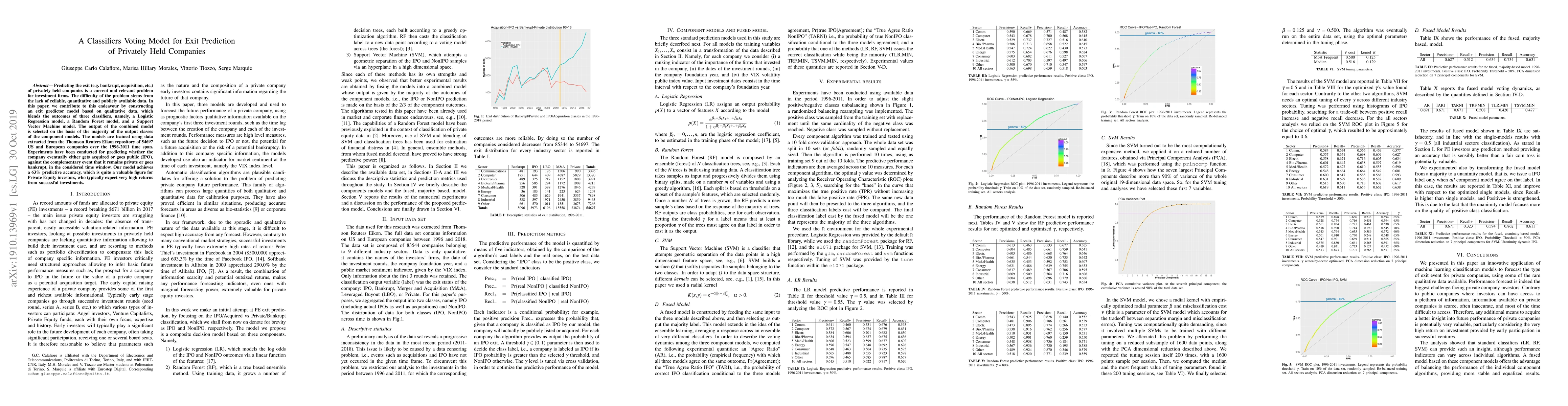

Predicting the exit (e.g. bankrupt, acquisition, etc.) of privately held companies is a current and relevant problem for investment firms. The difficulty of the problem stems from the lack of reliable, quantitative and publicly available data. In this paper, we contribute to this endeavour by constructing an exit predictor model based on qualitative data, which blends the outcomes of three classifiers, namely, a Logistic Regression model, a Random Forest model, and a Support Vector Machine model. The output of the combined model is selected on the basis of the majority of the output classes of the component models. The models are trained using data extracted from the Thomson Reuters Eikon repository of 54697 US and European companies over the 1996-2011 time span. Experiments have been conducted for predicting whether the company eventually either gets acquired or goes public (IPO), against the complementary event that it remains private or goes bankrupt, in the considered time window. Our model achieves a 63\% predictive accuracy, which is quite a valuable figure for Private Equity investors, who typically expect very high returns from successful investments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImproved Margin Generalization Bounds for Voting Classifiers

Kasper Green Larsen, Mikael Møller Høgsgaard

On Margins and Generalisation for Voting Classifiers

Valentina Zantedeschi, Benjamin Guedj, Felix Biggs

BEEM: Boosting Performance of Early Exit DNNs using Multi-Exit Classifiers as Experts

Divya Jyoti Bajpai, Manjesh Kumar Hanawal

| Title | Authors | Year | Actions |

|---|

Comments (0)