Summary

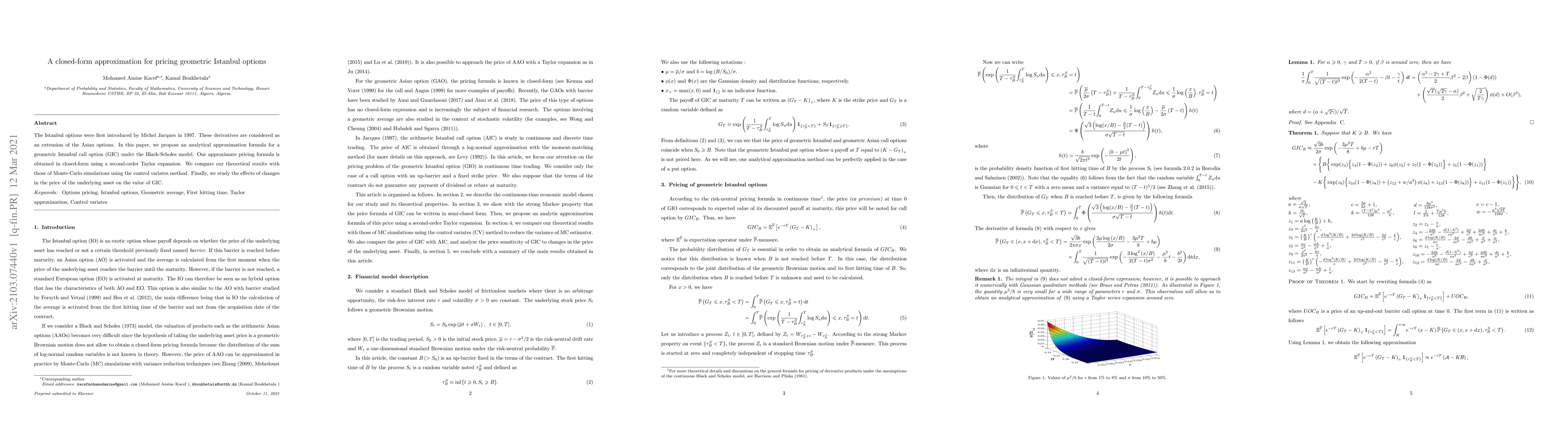

The Istanbul options were first introduced by Michel Jacques in 1997. These derivatives are considered as an extension of the Asian options. In this paper, we propose an analytical approximation formula for a geometric Istanbul call option (GIC) under the Black-Scholes model. Our approximate pricing formula is obtained in closed-form using a second-order Taylor expansion. We compare our theoretical results with those of Monte-Carlo simulations using the control variates method. Finally, we study the effects of changes in the price of the underlying asset on the value of GIC.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPricing of geometric Asian options in the Volterra-Heston model

Florian Aichinger, Sascha Desmettre

No citations found for this paper.

Comments (0)