Summary

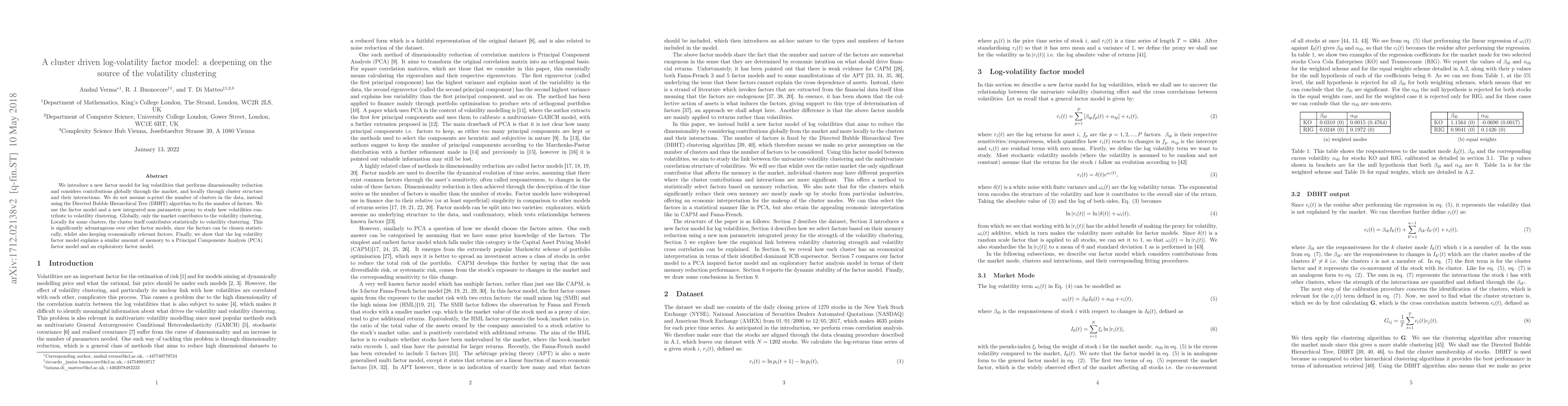

We introduce a new factor model for log volatilities that performs dimensionality reduction and considers contributions globally through the market, and locally through cluster structure and their interactions. We do not assume a-priori the number of clusters in the data, instead using the Directed Bubble Hierarchical Tree (DBHT) algorithm to fix the number of factors. We use the factor model and a new integrated non parametric proxy to study how volatilities contribute to volatility clustering. Globally, only the market contributes to the volatility clustering. Locally for some clusters, the cluster itself contributes statistically to volatility clustering. This is significantly advantageous over other factor models, since the factors can be chosen statistically, whilst also keeping economically relevant factors. Finally, we show that the log volatility factor model explains a similar amount of memory to a Principal Components Analysis (PCA) factor model and an exploratory factor model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)