Summary

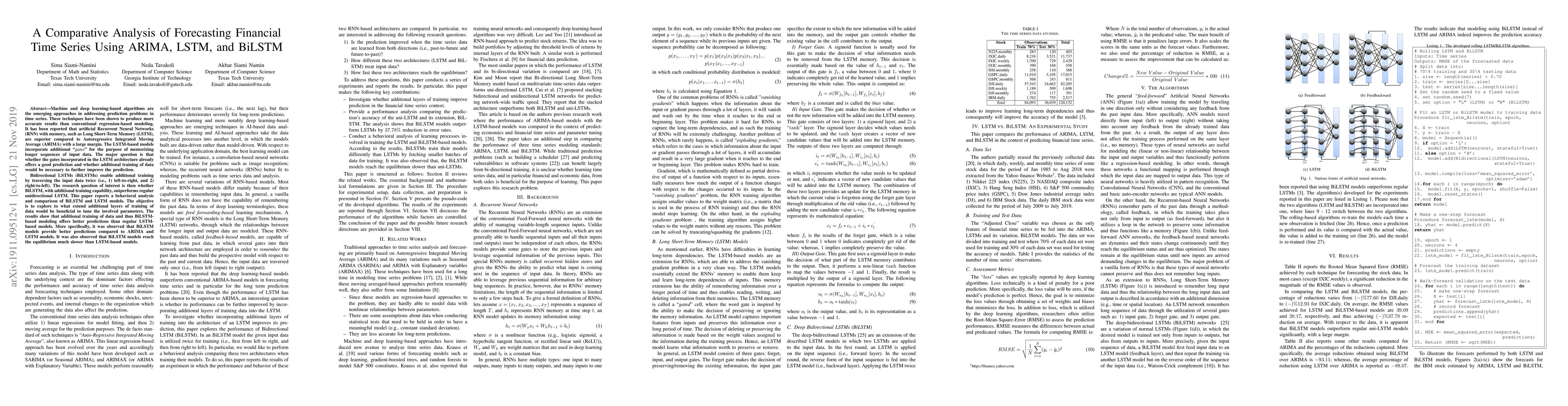

Machine and deep learning-based algorithms are the emerging approaches in addressing prediction problems in time series. These techniques have been shown to produce more accurate results than conventional regression-based modeling. It has been reported that artificial Recurrent Neural Networks (RNN) with memory, such as Long Short-Term Memory (LSTM), are superior compared to Autoregressive Integrated Moving Average (ARIMA) with a large margin. The LSTM-based models incorporate additional "gates" for the purpose of memorizing longer sequences of input data. The major question is that whether the gates incorporated in the LSTM architecture already offers a good prediction and whether additional training of data would be necessary to further improve the prediction. Bidirectional LSTMs (BiLSTMs) enable additional training by traversing the input data twice (i.e., 1) left-to-right, and 2) right-to-left). The research question of interest is then whether BiLSTM, with additional training capability, outperforms regular unidirectional LSTM. This paper reports a behavioral analysis and comparison of BiLSTM and LSTM models. The objective is to explore to what extend additional layers of training of data would be beneficial to tune the involved parameters. The results show that additional training of data and thus BiLSTM-based modeling offers better predictions than regular LSTM-based models. More specifically, it was observed that BiLSTM models provide better predictions compared to ARIMA and LSTM models. It was also observed that BiLSTM models reach the equilibrium much slower than LSTM-based models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTime series forecasting for multidimensional telemetry data using GAN and BiLSTM in a Digital Twin

Claudio Miceli de Farias, Joao Carmo de Almeida Neto, Leandro Santiago de Araujo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)