Summary

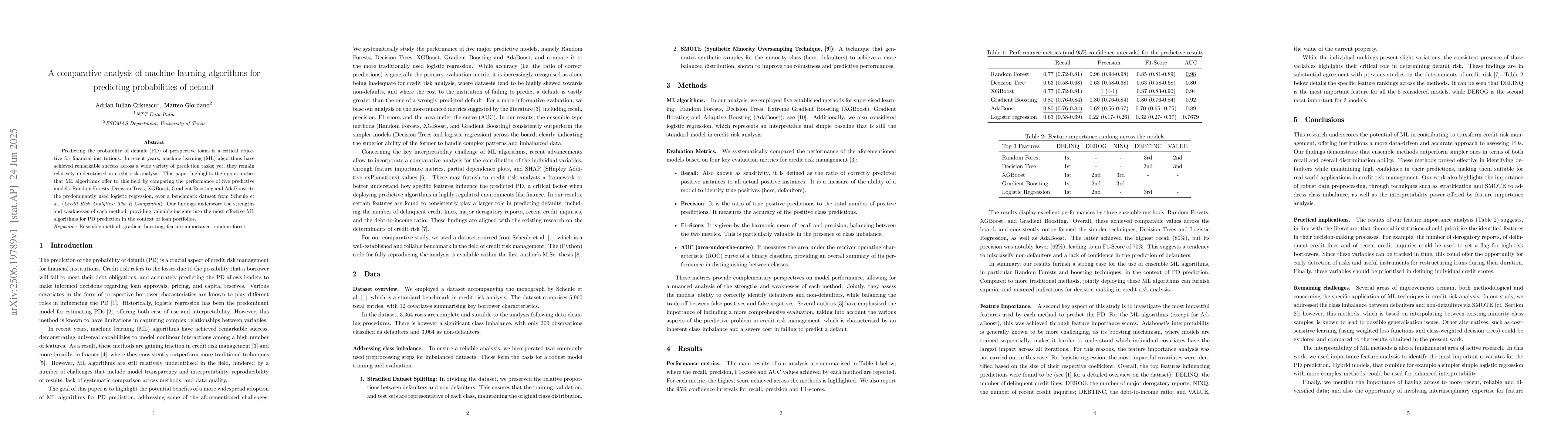

Predicting the probability of default (PD) of prospective loans is a critical objective for financial institutions. In recent years, machine learning (ML) algorithms have achieved remarkable success across a wide variety of prediction tasks; yet, they remain relatively underutilised in credit risk analysis. This paper highlights the opportunities that ML algorithms offer to this field by comparing the performance of five predictive models-Random Forests, Decision Trees, XGBoost, Gradient Boosting and AdaBoost-to the predominantly used logistic regression, over a benchmark dataset from Scheule et al. (Credit Risk Analytics: The R Companion). Our findings underscore the strengths and weaknesses of each method, providing valuable insights into the most effective ML algorithms for PD prediction in the context of loan portfolios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredicting radiation-acute esophagitis via machine learning algorithms.

Khodaei, Amin, Alizade-Harakiyan, Mostafa, Zamani, Hamed et al.

Machine Learning for Predicting Post-Partum Anemia: A Comparative Performance Analysis.

M, Settino, D, Mazzuca, F, Zinno et al.

No citations found for this paper.

Comments (0)