Summary

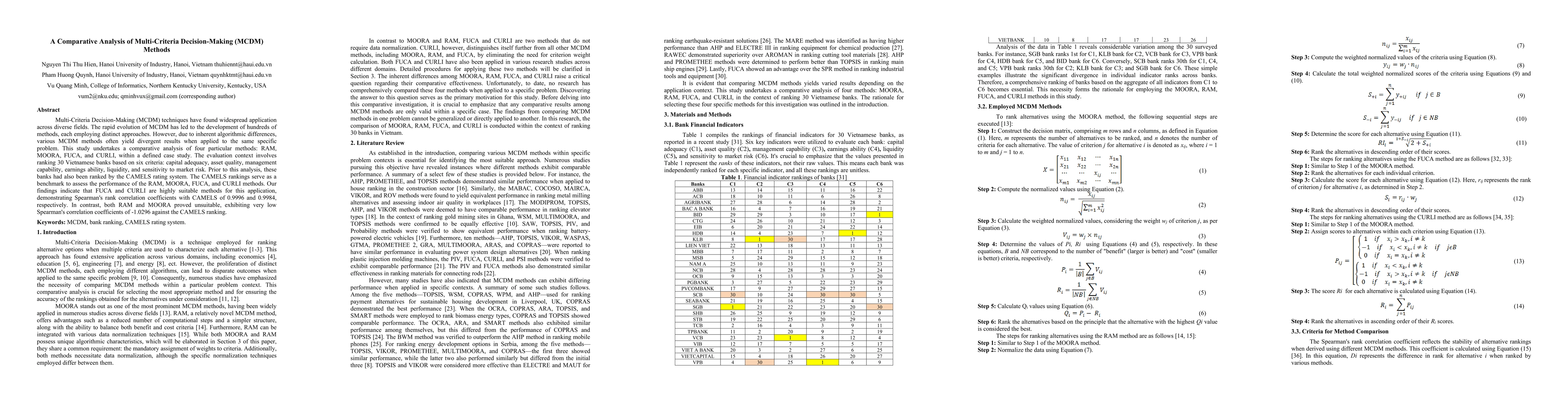

Multi-Criteria Decision-Making (MCDM) techniques have found widespread application across diverse fields. The rapid evolution of MCDM has led to the development of hundreds of methods, each employing distinct approaches. However, due to inherent algorithmic differences, various MCDM methods often yield divergent results when applied to the same specific problem. This study undertakes a comparative analysis of four particular methods: RAM, MOORA, FUCA, and CURLI, within a defined case study. The evaluation context involves ranking 30 Vietnamese banks based on six criteria: capital adequacy, asset quality, management capability, earnings ability, liquidity, and sensitivity to market risk. Prior to this analysis, these banks had also been ranked by the CAMELS rating system. The CAMELS rankings serve as a benchmark to assess the performance of the RAM, MOORA, FUCA, and CURLI methods. Our findings indicate that FUCA and CURLI are highly suitable methods for this application, demonstrating Spearman's rank correlation coefficients with CAMELS of 0.9996 and 0.9984, respectively. In contrast, both RAM and MOORA proved unsuitable, exhibiting very low Spearman's correlation coefficients of -1.0296 against the CAMELS ranking.

AI Key Findings

Generated Nov 02, 2025

Methodology

The study compared four MCDM methods (RAM, MOORA, FUCA, CURLI) using Spearman's rank correlation coefficient against the CAMELS rating system to rank 30 Vietnamese banks based on six financial criteria.

Key Results

- FUCA and CURLI showed high correlation (0.9996 and 0.9984) with CAMELS rankings

- RAM and MOORA showed extremely low correlation (-1.0265) with CAMELS rankings

- FUCA and CURLI produced rankings most consistent with CAMELS system

Significance

This research identifies suitable MCDM methods for banking sector evaluation, improving decision-making accuracy in financial institutions ranking

Technical Contribution

Demonstrated how data normalization affects MCDM outcomes and identified appropriate methods for dimensionally consistent criteria

Novelty

First comparative analysis of FUCA and CURLI methods in banking sector with CAMELS benchmark

Limitations

- Limited to Vietnamese banks only

- Focus on six specific financial criteria

Future Work

- Explore application in other financial sectors

- Investigate impact of different normalization techniques

Paper Details

PDF Preview

Similar Papers

Found 4 papersAlgorithms for Multi-Criteria Decision-Making and Efficiency Analysis Problems

Fuh-Hwa Franklin Liu, Su-Chuan Shih

Comments (0)