Summary

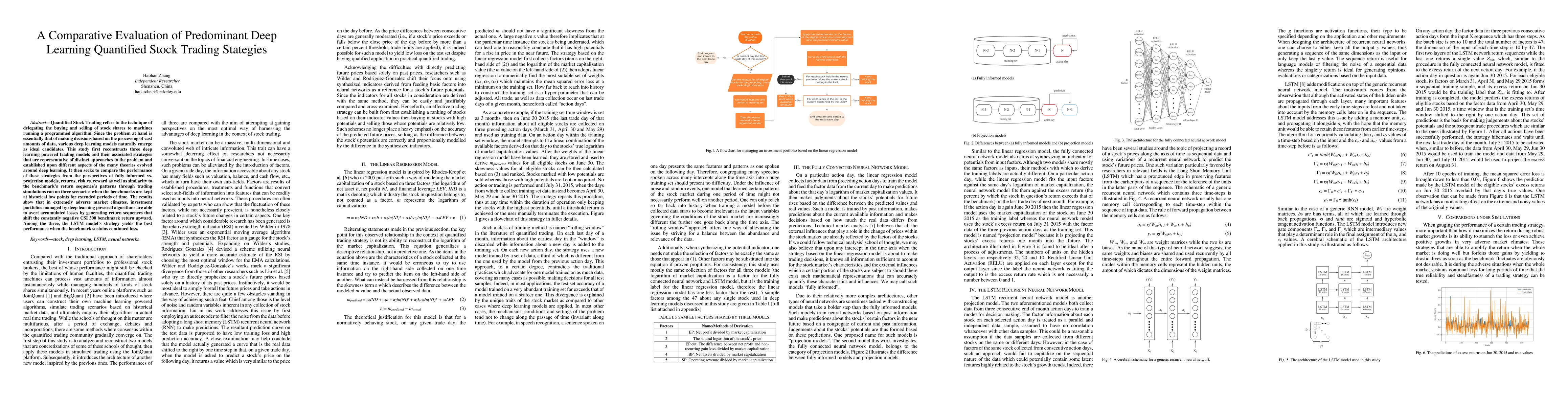

This study first reconstructs three deep learning powered stock trading models and their associated strategies that are representative of distinct approaches to the problem and established upon different aspects of the many theories evolved around deep learning. It then seeks to compare the performance of these strategies from different perspectives through trading simulations ran on three scenarios when the benchmarks are kept at historical low points for extended periods of time. The results show that in extremely adverse market climates, investment portfolios managed by deep learning powered algorithms are able to avert accumulated losses by generating return sequences that shift the constantly negative CSI 300 benchmark return upward. Among the three, the LSTM model's strategy yields the best performance when the benchmark sustains continued loss.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPractical Deep Reinforcement Learning Approach for Stock Trading

Xiao-Yang Liu, Shan Zhong, Hongyang Yang et al.

Directly Learning Stock Trading Strategies Through Profit Guided Loss Functions

Hao Zhang, Travis Desell, Zimeng Lyu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)