Summary

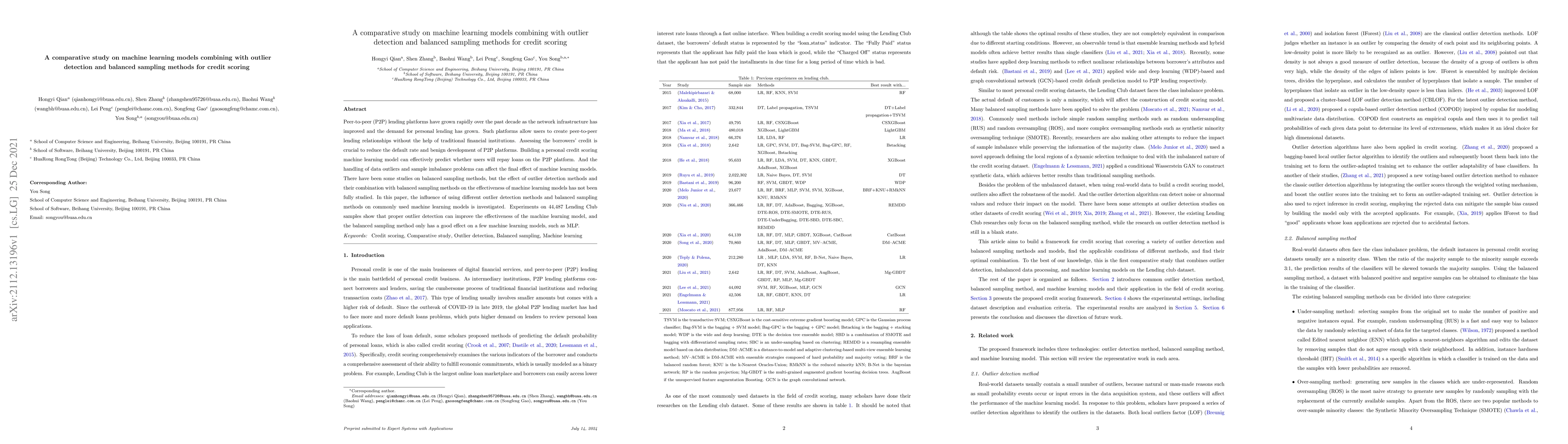

Peer-to-peer (P2P) lending platforms have grown rapidly over the past decade as the network infrastructure has improved and the demand for personal lending has grown. Such platforms allow users to create peer-to-peer lending relationships without the help of traditional financial institutions. Assessing the borrowers' credit is crucial to reduce the default rate and benign development of P2P platforms. Building a personal credit scoring machine learning model can effectively predict whether users will repay loans on the P2P platform. And the handling of data outliers and sample imbalance problems can affect the final effect of machine learning models. There have been some studies on balanced sampling methods, but the effect of outlier detection methods and their combination with balanced sampling methods on the effectiveness of machine learning models has not been fully studied. In this paper, the influence of using different outlier detection methods and balanced sampling methods on commonly used machine learning models is investigated. Experiments on 44,487 Lending Club samples show that proper outlier detection can improve the effectiveness of the machine learning model, and the balanced sampling method only has a good effect on a few machine learning models, such as MLP.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn experimental study on fairness-aware machine learning for credit scoring problem

Tai Le Quy, Thang Viet Doan, Huyen Giang Thi Thu

Quantum Machine Learning for Credit Scoring

Davit Aghamalyan, Paul Griffin, Nikolaos Schetakis et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)