Summary

In a Markovian framework, we consider the problem of finding the minimal initial value of a controlled process allowing to reach a stochastic target with a given level of expected loss. This question arises typically in approximate hedging problems. The solution to this problem has been characterised by Bouchard, Elie and Touzi in [1] and is known to solve an Hamilton-Jacobi-Bellman PDE with discontinuous operator. In this paper, we prove a comparison theorem for the corresponding PDE by showing first that it can be rewritten using a continuous operator, in some cases. As an application, we then study the quantile hedging price of Bermudan options in the non-linear case, pursuing the study initiated in [2]. [1] Bruno Bouchard, Romuald Elie, and Nizar Touzi. Stochastic target problems with controlled loss. SIAM Journal on Control and Optimization, 48(5):3123-3150,2009. [2] Bruno Bouchard, Romuald Elie, Antony R\'eveillac, et al. Bsdes with weak terminal condition. The Annals of Probability, 43(2):572-604,2015.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

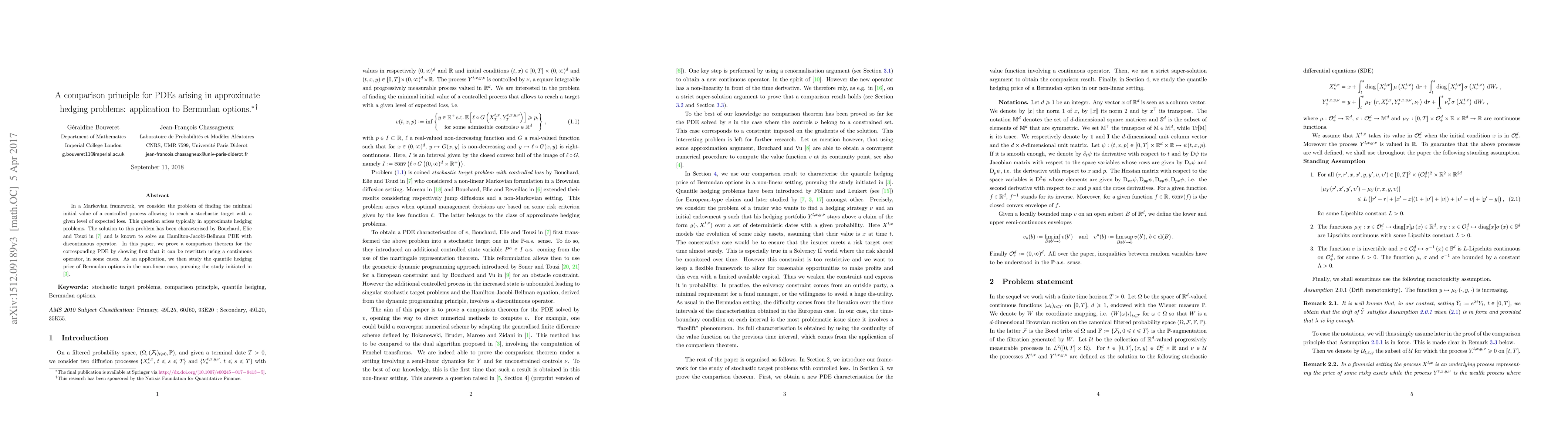

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA pure dual approach for hedging Bermudan options

Ahmed Kebaier, Aurélien Alfonsi, Jérôme Lelong

| Title | Authors | Year | Actions |

|---|

Comments (0)