Summary

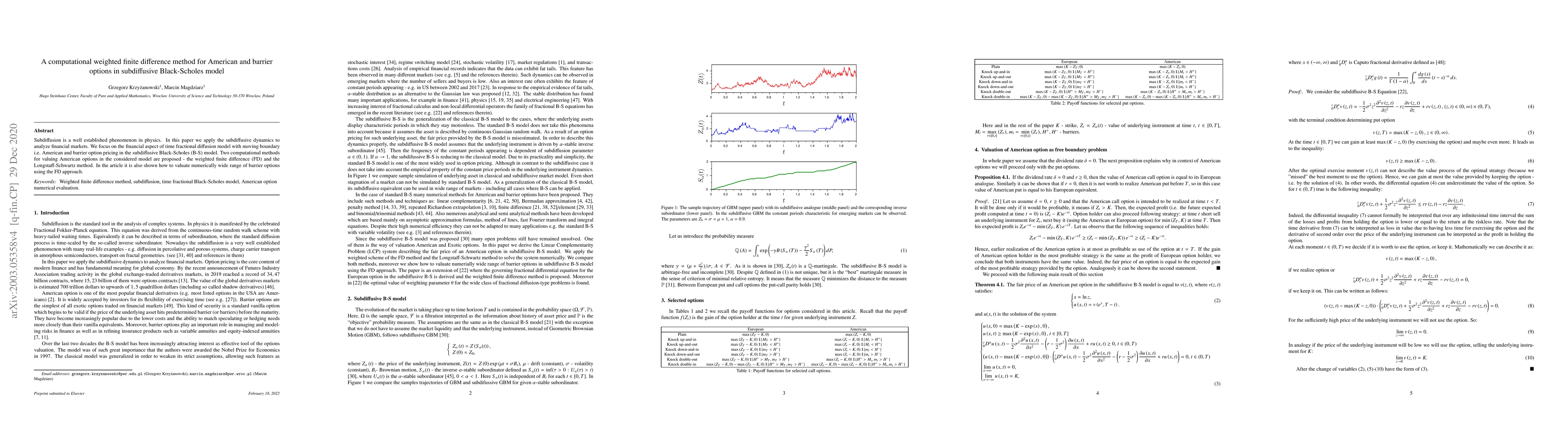

Subdiffusion is a well established phenomenon in physics. In this paper we apply the subdiffusive dynamics to analyze financial markets. We focus on the financial aspect of time fractional diffusion model with moving boundary i.e. American and barrier option pricing in the subdiffusive Black-Scholes (B-S) model. Two computational methods for valuing American options in the considered model are proposed - the weighted finite difference (FD) and the Longstaff-Schwartz method. In the article it is also shown how to valuate numerically wide range of barrier options using the FD approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA tempered subdiffusive Black-Scholes model

Marcin Magdziarz, Grzegorz Krzyżanowski

| Title | Authors | Year | Actions |

|---|

Comments (0)