Summary

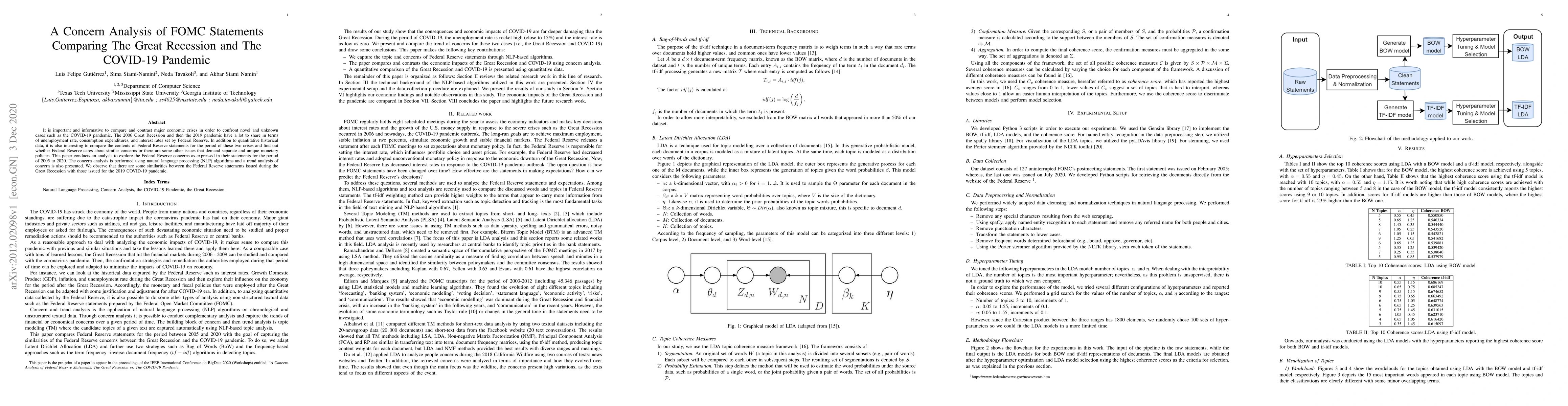

It is important and informative to compare and contrast major economic crises in order to confront novel and unknown cases such as the COVID-19 pandemic. The 2006 Great Recession and then the 2019 pandemic have a lot to share in terms of unemployment rate, consumption expenditures, and interest rates set by Federal Reserve. In addition to quantitative historical data, it is also interesting to compare the contents of Federal Reserve statements for the period of these two crises and find out whether Federal Reserve cares about similar concerns or there are some other issues that demand separate and unique monetary policies. This paper conducts an analysis to explore the Federal Reserve concerns as expressed in their statements for the period of 2005 to 2020. The concern analysis is performed using natural language processing (NLP) algorithms and a trend analysis of concern is also presented. We observe that there are some similarities between the Federal Reserve statements issued during the Great Recession with those issued for the 2019 COVID-19 pandemic.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHow Well Did U.S. Rail and Intermodal Freight Respond to the COVID-19 Pandemic vs. the Great Recession?

Max T. M. Ng, Hani S. Mahmassani, Joseph Schofer

Recreational Mobility Prior and During the COVID-19 Pandemic

Afra Mashhadi, Marc Timme, Fakhteh Ghanbarnejad et al.

No citations found for this paper.

Comments (0)