Summary

We study a constrained optimal control problem with possibly degenerate coefficients arising in models of optimal portfolio liquidation under market impact. The coefficients can be random in which case the value function is described by a degenerate backward stochastic partial differential equation (BSPDE) with singular terminal condition. For this degenerate BSPDE, we prove existence and uniqueness of a nonnegative solution. Our existence result requires a novel gradient estimate for degenerate BSPDEs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

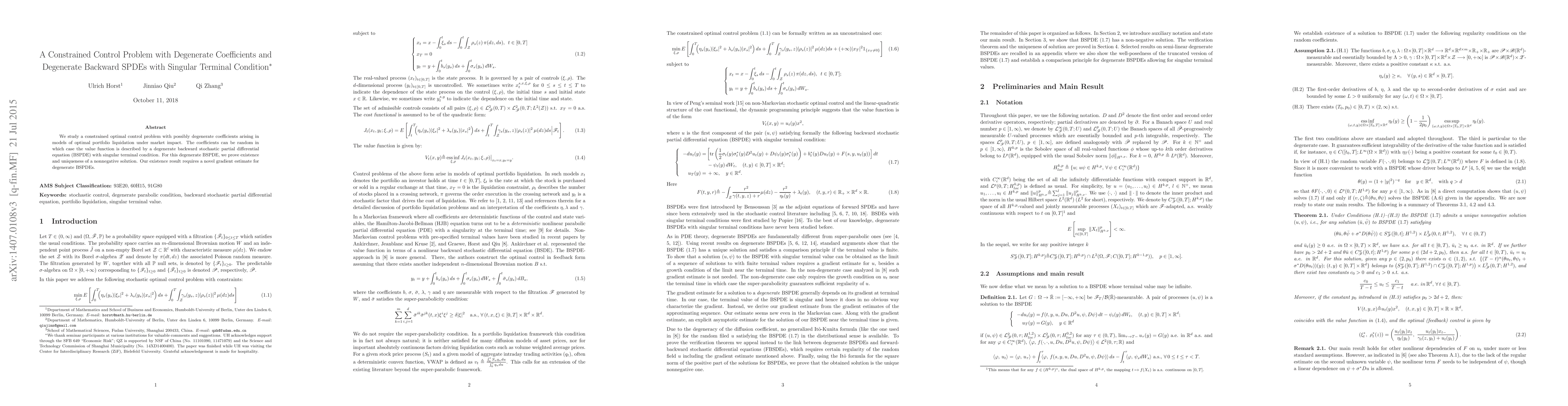

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)