Summary

The Allais and Ellsberg paradoxes show that the expected utility hypothesis and Savage's Sure-Thing Principle are violated in real life decisions. The popular explanation in terms of 'ambiguity aversion' is not completely accepted. On the other hand, we have recently introduced a notion of 'contextual risk' to mathematically capture what is known as 'ambiguity' in the economics literature. Situations in which contextual risk occurs cannot be modeled by Kolmogorovian classical probabilistic structures, but a non-Kolmogorovian framework with a quantum-like structure is needed. We prove in this paper that the contextual risk approach can be applied to the Ellsberg paradox, and elaborate a 'sphere model' within our 'hidden measurement formalism' which reveals that it is the overall conceptual landscape that is responsible of the disagreement between actual human decisions and the predictions of expected utility theory, which generates the paradox. This result points to the presence of a 'quantum conceptual layer' in human thought which is superposed to the usually assumed 'classical logical layer'.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

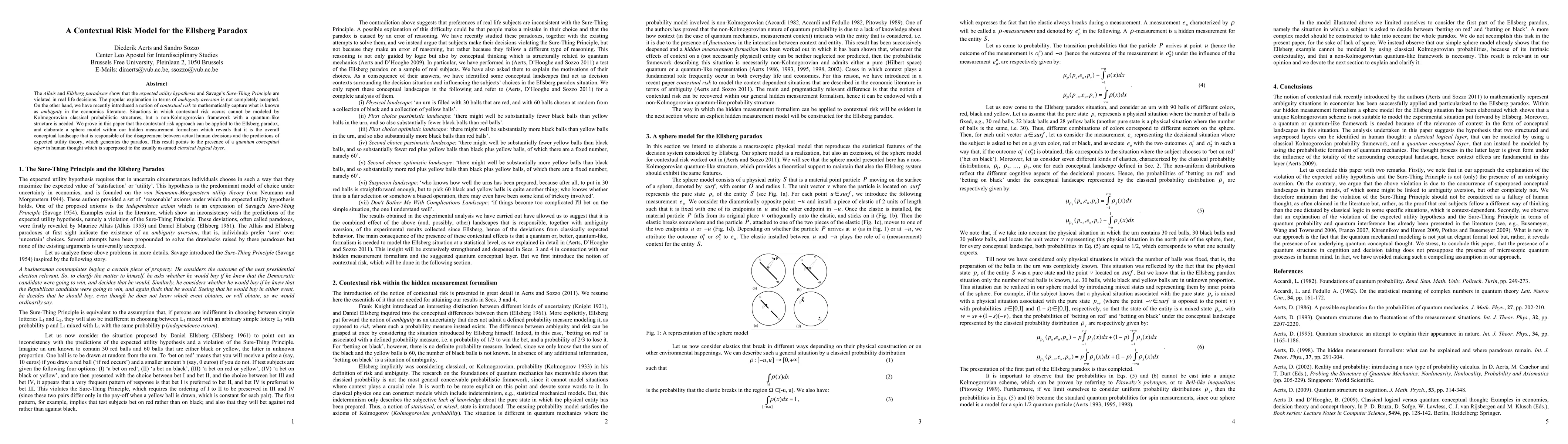

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Ellsberg paradox for ambiguity aversion

Christoph Kuzmics, Brian W. Rogers, Xiannong Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)