Summary

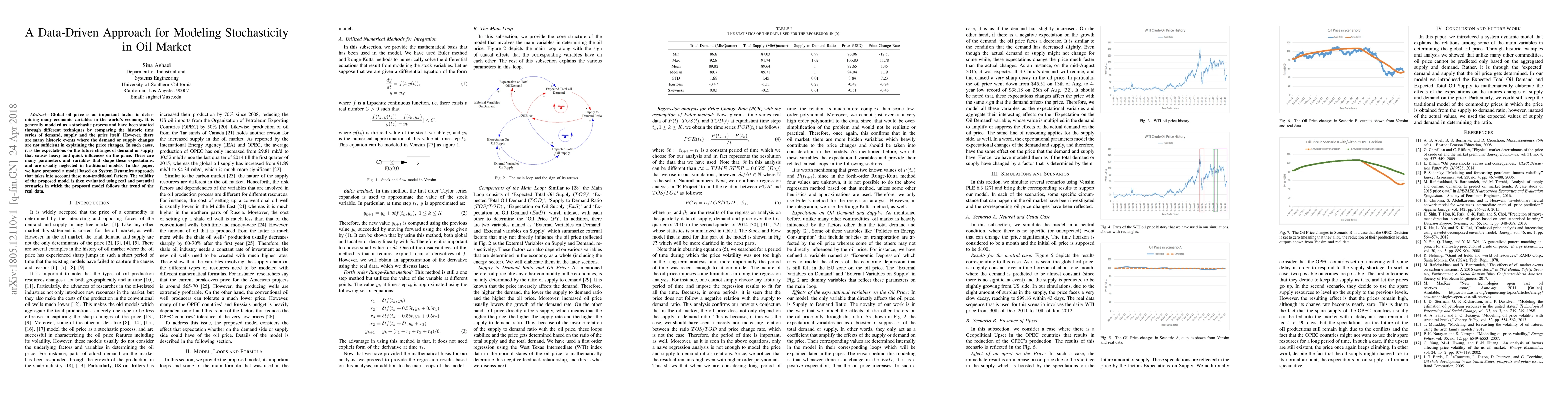

Global oil price is an important factor in determining many economic variables in the world's economy. It is generally modeled as a stochastic process and have been studied through different techniques by comparing the historic time series of demand, supply and the price itself. However, there are many historic events where the demand or supply changes are not sufficient in explaining the price changes. In such cases, it is the expectations on the future changes of demand or supply that causes heavy and quick influences on the price. There are many parameters and variables that shape these expectations, and are usually neglected in traditional models. In this paper, we have proposed a model based on System Dynamics approach that takes into account these non-traditional factors. The validity of the proposed model is then evaluated using real and potential scenarios in which the proposed model follows the trend of the real data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)