Authors

Summary

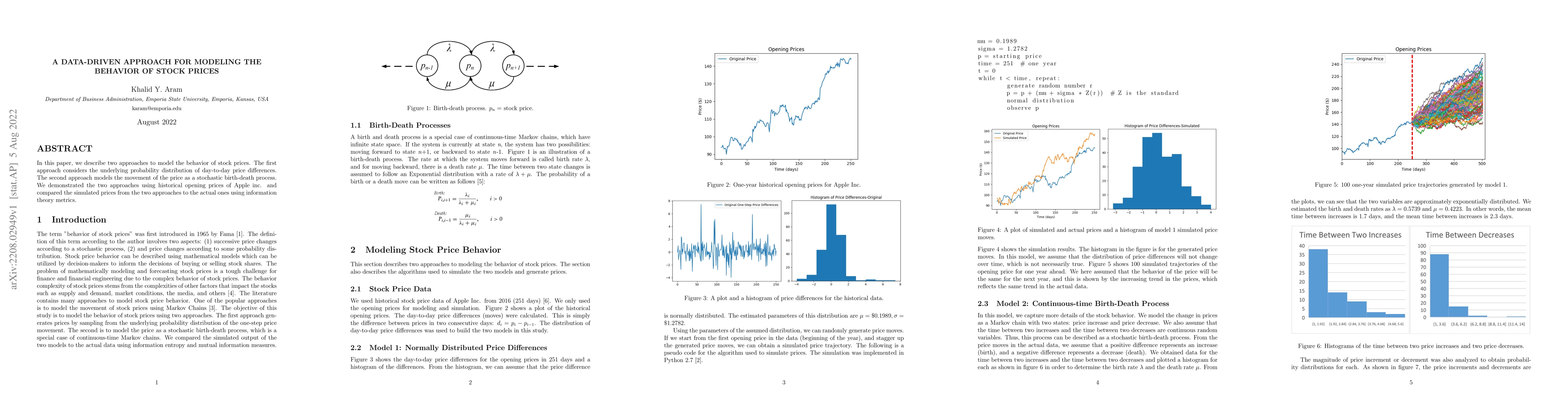

In this paper, we describe two approaches to model the behavior of stock prices. The first approach considers the underlying probability distribution of day-to-day price differences. The second approach models the movement of the price as a stochastic birth-death process. We demonstrated the two approaches using historical opening prices of Apple inc. and compared the simulated prices from the two approaches to the actual ones using information theory metrics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModeling stock price dynamics on the Ghana Stock Exchange: A Geometric Brownian Motion approach

Dennis Lartey Quayesam, Anani Lotsi, Felix Okoe Mettle

No citations found for this paper.

Comments (0)