Summary

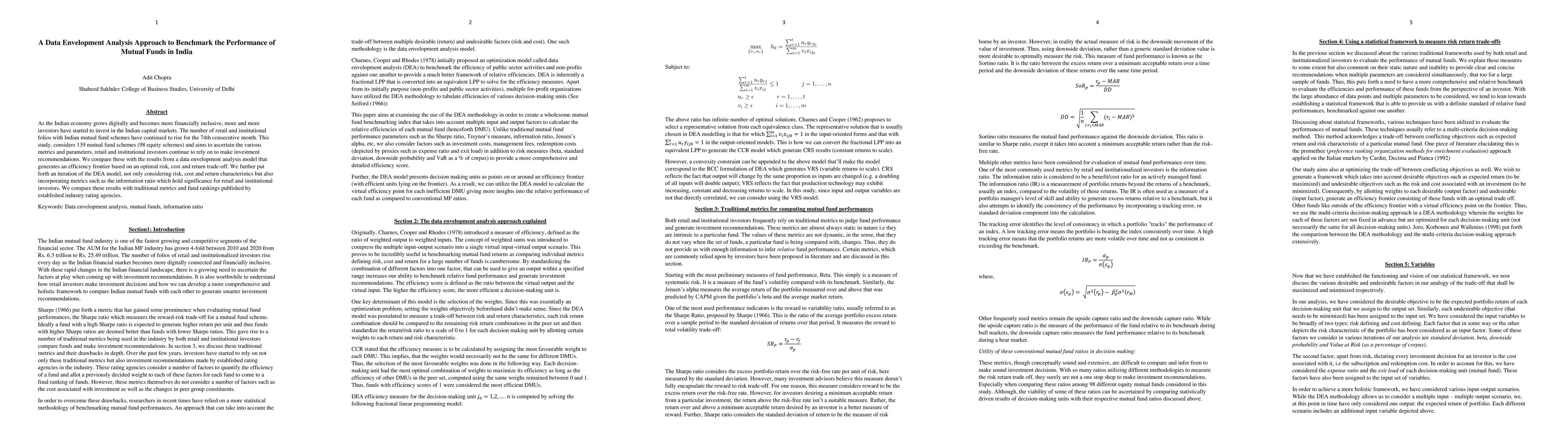

As the Indian economy grows digitally and becomes more financially inclusive, more and more investors have started to invest in the Indian capital markets. The number of retail and institutional folios with Indian mutual fund schemes have continued to rise for the 74th consecutive month. This study considers 139 mutual fund schemes (98 equity schemes) and aims to ascertain the various metrics and parameters, retail and institutional investors continue to rely on to make investment recommendations. We compare these with the results from a data envelopment analysis model that generates an efficiency frontier based on an optimal risk, cost, and return trade-off. We further put forth an iteration of the DEA model, not only considering risk, cost, and return characteristics but also incorporating metrics such as the information ratio which hold significance for retail and institutional investors. We compare these results with traditional metrics and fund rankings published by established industry rating agencies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)