Summary

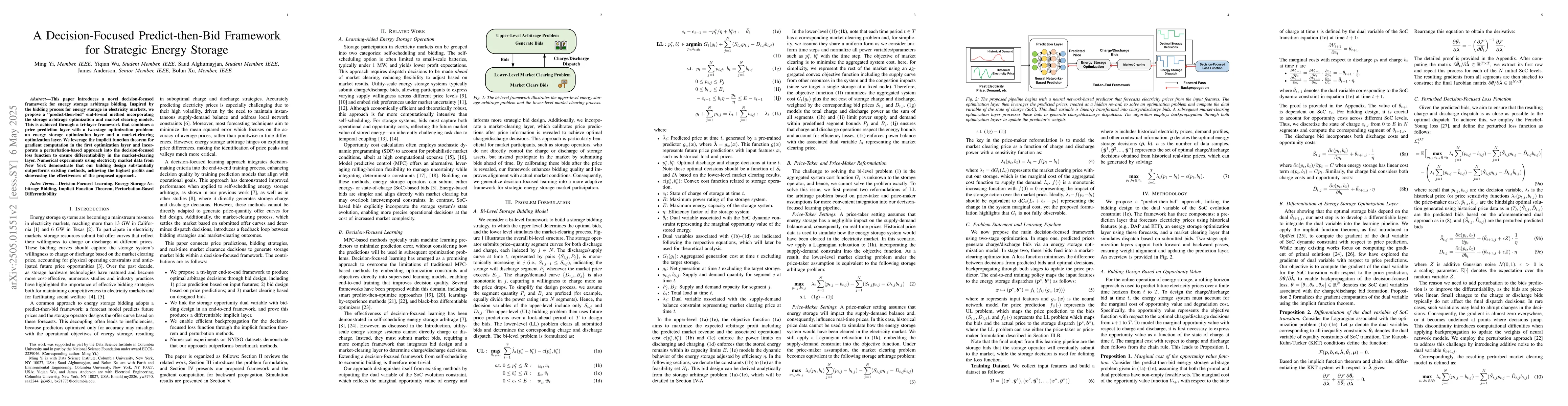

This paper introduces a novel decision-focused framework for energy storage arbitrage bidding. Inspired by the bidding process for energy storage in electricity markets, we propose a predict-then-bid end-to-end method incorporating the storage arbitrage optimization and market clearing models. This is achieved through a tri-layer framework that combines a price prediction layer with a two-stage optimization problem: an energy storage optimization layer and a market-clearing optimization layer. We leverage the implicit function theorem for gradient computation in the first optimization layer and incorporate a perturbation-based approach into the decision-focused loss function to ensure differentiability in the market-clearing layer. Numerical experiments using electricity market data from New York demonstrate that our bidding design substantially outperforms existing methods, achieving the highest profits and showcasing the effectiveness of the proposed approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPerturbed Decision-Focused Learning for Modeling Strategic Energy Storage

Ming Yi, Bolun Xu, Saud Alghumayjan

DFF: Decision-Focused Fine-tuning for Smarter Predict-then-Optimize with Limited Data

Jiaqi Yang, Zhichao Zou, Jiecheng Guo et al.

Electricity Price Prediction for Energy Storage System Arbitrage: A Decision-focused Approach

Hongbin Sun, Huan Long, Linwei Sang et al.

No citations found for this paper.

Comments (0)