Summary

We study the discrete-time approximation for solutions of quadratic forward back- ward stochastic differential equations (FBSDEs) driven by a Brownian motion and a jump process which could be dependent. Assuming that the generator has a quadratic growth w.r.t. the variable z and the terminal condition is bounded, we prove the convergence of the scheme when the number of time steps n goes to infinity. Our approach is based on the companion paper [15] and allows to get a convergence rate similar to that of schemes of Brownian FBSDEs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

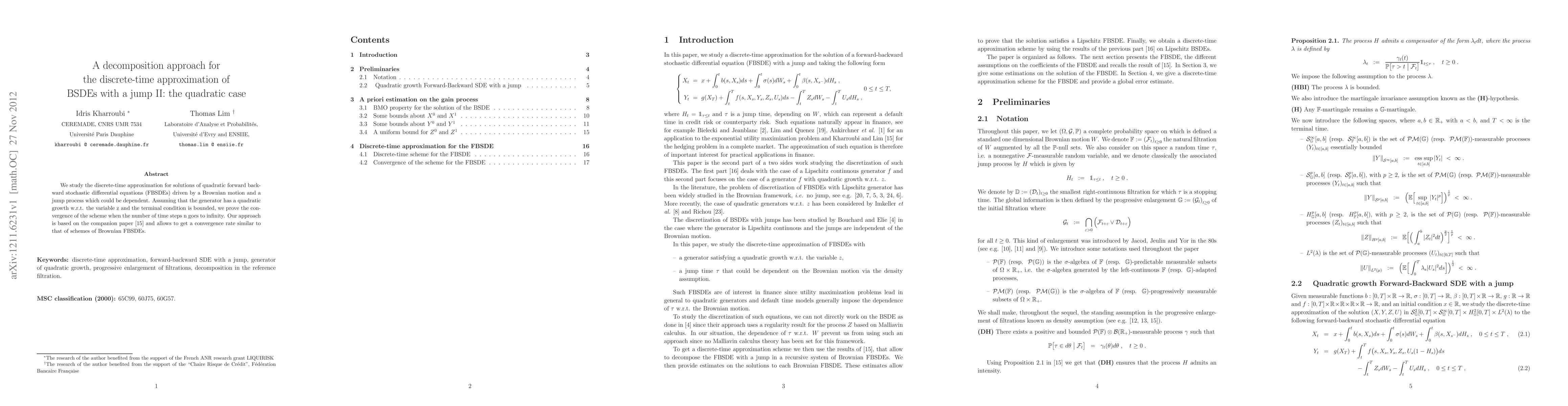

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)