Summary

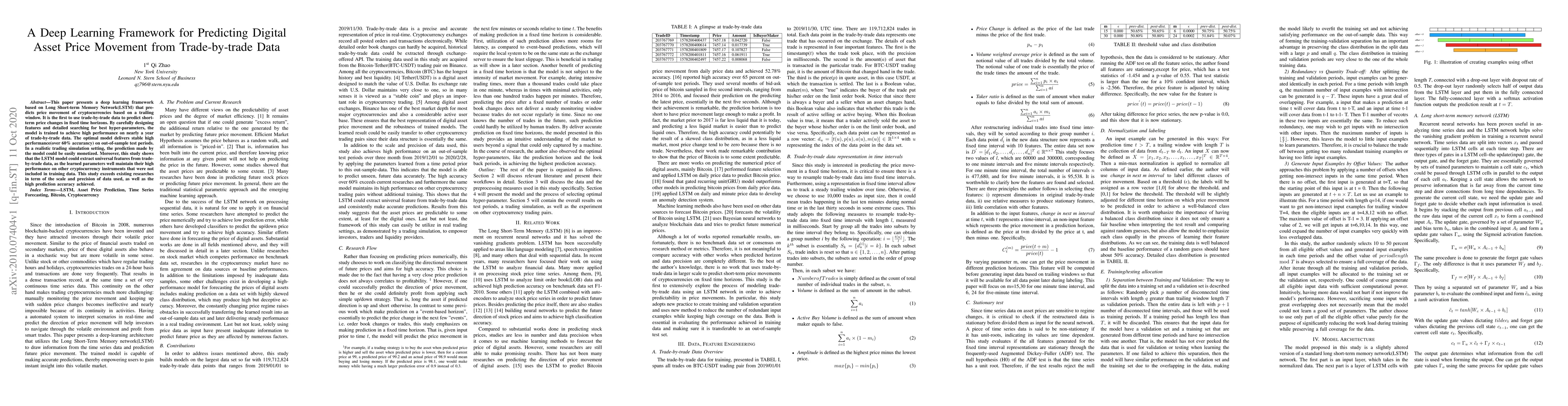

This paper presents a deep learning framework based on Long Short-term Memory Network(LSTM) that predicts price movement of cryptocurrencies from trade-by-trade data. The main focus of this study is on predicting short-term price changes in a fixed time horizon from a looking back period. By carefully designing features and detailed searching for best hyper-parameters, the model is trained to achieve high performance on nearly a year of trade-by-trade data. The optimal model delivers stable high performance(over 60% accuracy) on out-of-sample test periods. In a realistic trading simulation setting, the prediction made by the model could be easily monetized. Moreover, this study shows that the LSTM model could extract universal features from trade-by-trade data, as the learned parameters well maintain their high performance on other cryptocurrency instruments that were not included in training data. This study exceeds existing researches in term of the scale and precision of data used, as well as the high prediction accuracy achieved.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEstimating Digital Product Trade through Corporate Revenue Data

Viktor Stojkoski, Philipp Koch, Eva Coll et al.

Detecting asset price bubbles using deep learning

Lukas Gonon, Francesca Biagini, Andrea Mazzon et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)