Summary

Traditional Long Short-Term Memory (LSTM) networks are effective for handling sequential data but have limitations such as gradient vanishing and difficulty in capturing long-term dependencies, which can impact their performance in dynamic and risky environments like stock trading. To address these limitations, this study explores the usage of the newly introduced Extended Long Short Term Memory (xLSTM) network in combination with a deep reinforcement learning (DRL) approach for automated stock trading. Our proposed method utilizes xLSTM networks in both actor and critic components, enabling effective handling of time series data and dynamic market environments. Proximal Policy Optimization (PPO), with its ability to balance exploration and exploitation, is employed to optimize the trading strategy. Experiments were conducted using financial data from major tech companies over a comprehensive timeline, demonstrating that the xLSTM-based model outperforms LSTM-based methods in key trading evaluation metrics, including cumulative return, average profitability per trade, maximum earning rate, maximum pullback, and Sharpe ratio. These findings mark the potential of xLSTM for enhancing DRL-based stock trading systems.

AI Key Findings

Generated Jun 10, 2025

Methodology

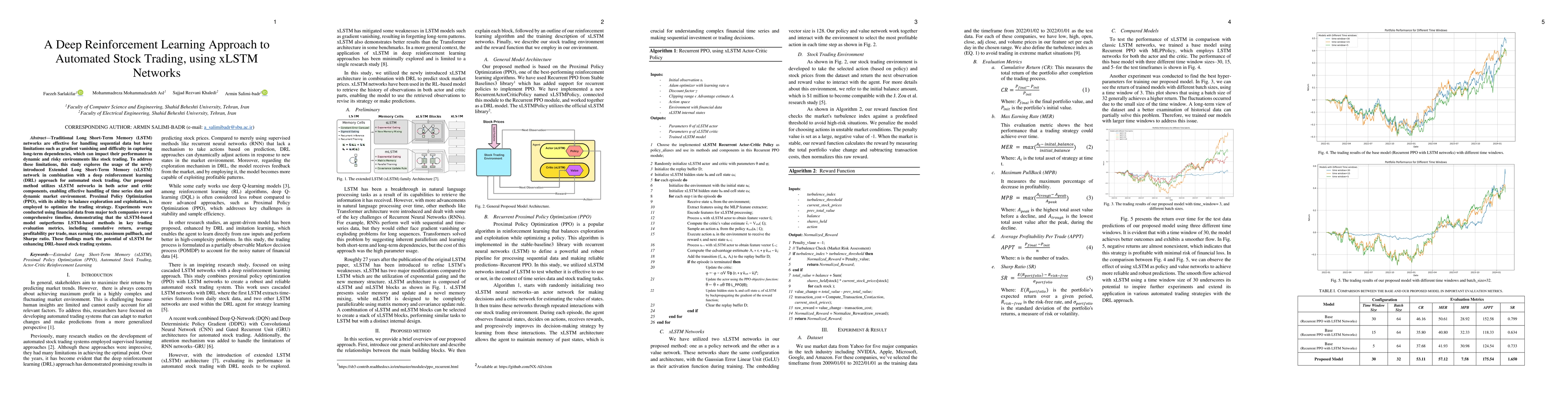

The research proposes a Deep Reinforcement Learning (DRL) approach for automated stock trading using xLSTM networks, which are an extension of traditional LSTM networks to mitigate gradient vanishing and improve long-term dependency handling. The xLSTM-based model utilizes Proximal Policy Optimization (PPO) for balancing exploration and exploitation, with xLSTM networks integrated into both actor and critic components.

Key Results

- The xLSTM-based model outperforms LSTM-based methods in key trading evaluation metrics, including cumulative return, average profitability per trade, maximum earning rate, maximum pullback, and Sharpe ratio.

- Experiments using financial data from major tech companies over a comprehensive timeline demonstrated the superiority of the xLSTM-based model.

- The use of xLSTM networks in DRL for stock trading shows potential for enhancing automated trading systems.

Significance

This research is significant as it addresses the limitations of traditional LSTM networks in dynamic and risky environments like stock trading by employing xLSTM networks, which improve handling of time series data and market volatility.

Technical Contribution

The paper introduces the application of xLSTM networks in combination with DRL for stock trading, showcasing their effectiveness in overcoming LSTM limitations and improving trading performance.

Novelty

While xLSTM networks have been introduced, their application in DRL for stock trading is minimally explored, with this study being one of the few to investigate this combination.

Limitations

- The computational resource requirement for training xLSTM networks can be high, making large-scale testing challenging.

- The study's scope is limited to five major tech companies' stock market data, which may not generalize to all market conditions or stock types.

Future Work

- Further exploration of powerful feature engineering to enhance model performance and trading strategy design.

- Investigation into ensemble modeling for xLSTM networks in actor or critic components.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Novel Deep Reinforcement Learning Based Automated Stock Trading System Using Cascaded LSTM Networks

Jie Zou, Jiashu Lou, Baohua Wang et al.

Practical Deep Reinforcement Learning Approach for Stock Trading

Xiao-Yang Liu, Shan Zhong, Hongyang Yang et al.

FinRL: A Deep Reinforcement Learning Library for Automated Stock Trading in Quantitative Finance

Qian Chen, Liuqing Yang, Xiao-Yang Liu et al.

No citations found for this paper.

Comments (0)