Authors

Summary

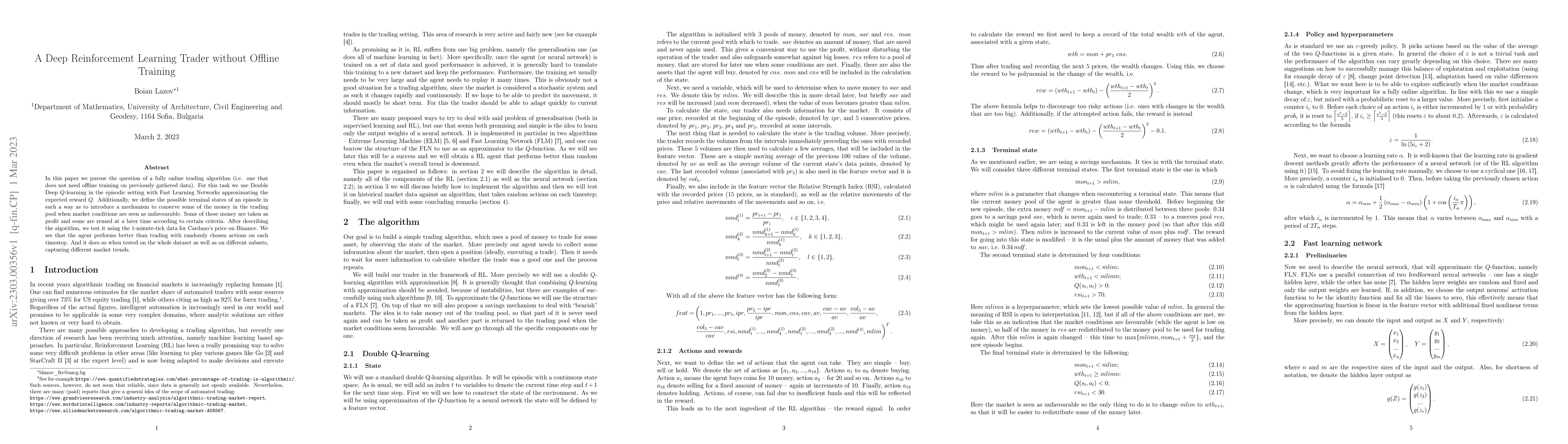

In this paper we pursue the question of a fully online trading algorithm (i.e. one that does not need offline training on previously gathered data). For this task we use Double Deep $Q$-learning in the episodic setting with Fast Learning Networks approximating the expected reward $Q$. Additionally, we define the possible terminal states of an episode in such a way as to introduce a mechanism to conserve some of the money in the trading pool when market conditions are seen as unfavourable. Some of these money are taken as profit and some are reused at a later time according to certain criteria. After describing the algorithm, we test it using the 1-minute-tick data for Cardano's price on Binance. We see that the agent performs better than trading with randomly chosen actions on each timestep. And it does so when tested on the whole dataset as well as on different subsets, capturing different market trends.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAvoidance Navigation Based on Offline Pre-Training Reinforcement Learning

Yang Wenkai Ji Ruihang Zhang Yuxiang Lei Hao, Zhao Zijie

Pre-training with Synthetic Data Helps Offline Reinforcement Learning

Zecheng Wang, Zixuan Dong, Che Wang et al.

d3rlpy: An Offline Deep Reinforcement Learning Library

Takuma Seno, Michita Imai

No citations found for this paper.

Comments (0)