Authors

Summary

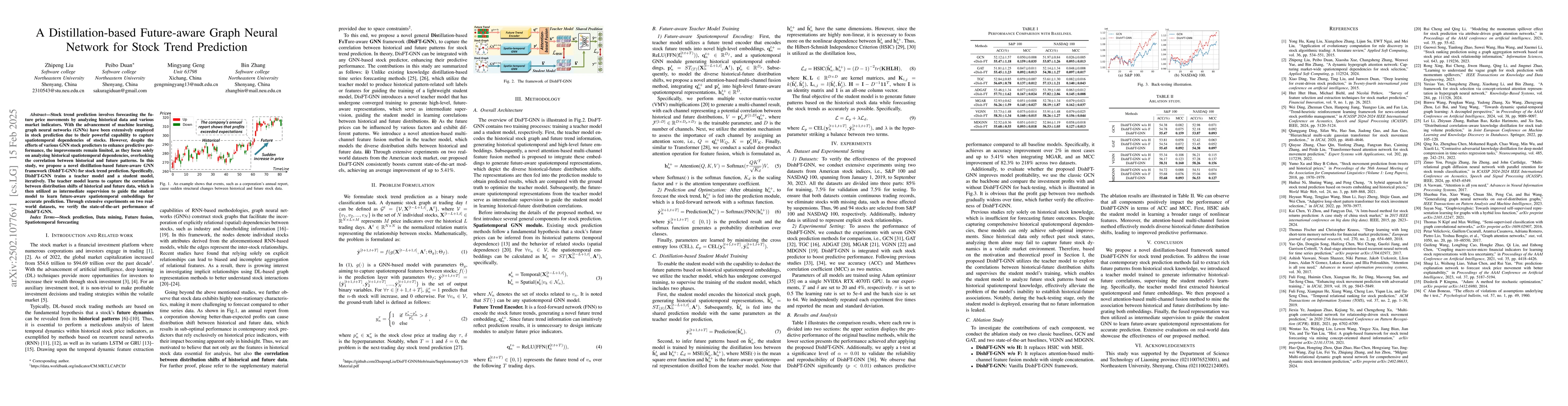

Stock trend prediction involves forecasting the future price movements by analyzing historical data and various market indicators. With the advancement of machine learning, graph neural networks (GNNs) have been extensively employed in stock prediction due to their powerful capability to capture spatiotemporal dependencies of stocks. However, despite the efforts of various GNN stock predictors to enhance predictive performance, the improvements remain limited, as they focus solely on analyzing historical spatiotemporal dependencies, overlooking the correlation between historical and future patterns. In this study, we propose a novel distillation-based future-aware GNN framework (DishFT-GNN) for stock trend prediction. Specifically, DishFT-GNN trains a teacher model and a student model, iteratively. The teacher model learns to capture the correlation between distribution shifts of historical and future data, which is then utilized as intermediate supervision to guide the student model to learn future-aware spatiotemporal embeddings for accurate prediction. Through extensive experiments on two real-world datasets, we verify the state-of-the-art performance of DishFT-GNN.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research proposes DishFT-GNN, a distillation-based future-aware GNN framework for stock trend prediction. It trains a teacher model and a student model iteratively. The teacher model learns to capture the correlation between distribution shifts of historical and future data, which is then used as intermediate supervision to guide the student model in learning future-aware spatiotemporal embeddings for accurate prediction.

Key Results

- DishFT-GNN significantly enhances predictive performance over baseline models, achieving an average improvement of up to 5.41% on two real-world datasets.

- DishFT-GNN improves model profitability in back-testing when integrated with the classic GCN as the backbone.

Significance

This research is important as it addresses the limitation of current stock prediction methods that fail to extract rich future patterns from historical stock knowledge. By introducing a teacher model to explore correlations between historical-future distribution shifts and supervising the student model's learning, DishFT-GNN enables the student model to analyze future stock patterns based on historical spatiotemporal knowledge, effectively alleviating the problem of models' inability to establish historical-future associations.

Technical Contribution

The main technical contribution is the introduction of a novel distillation-based future-aware GNN framework (DishFT-GNN) for stock trend prediction, which utilizes a teacher model to generate informative historical-future correlations, supervising the student model's learning.

Novelty

DishFT-GNN stands out by incorporating future-awareness into GNN-based stock prediction models through a teacher-student distillation framework, capturing diverse historical-future distribution shifts, and providing intermediate supervision for future-aware spatiotemporal representation learning.

Limitations

- The paper does not discuss potential challenges in obtaining reliable future data for training.

- Limitations in generalizability to diverse market conditions or stock types are not addressed.

Future Work

- Investigate the applicability of DishFT-GNN to other financial time-series prediction tasks.

- Explore the integration of DishFT-GNN with other machine learning or deep learning models for enhanced performance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersStock Type Prediction Model Based on Hierarchical Graph Neural Network

Jianhua Yao, Yuxin Dong, Hongye Zheng et al.

ChatGPT Informed Graph Neural Network for Stock Movement Prediction

Zihan Chen, Cheng Lu, Di Zhu et al.

No citations found for this paper.

Comments (0)